Drake Tax - Entity Names (1065, 1120, 1120-S)

Article #: 15052

Last Updated: December 05, 2024

The Entity Name fields have changed to make "Doing Business As (DBA)" fields more user friendly and to allow longer entity names to be entered for some forms.

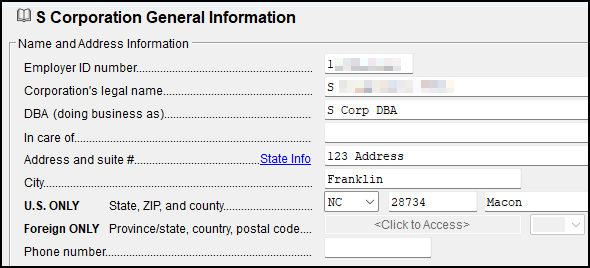

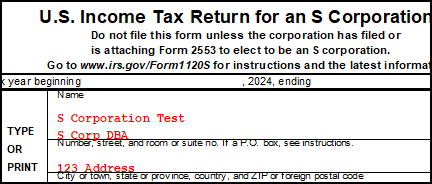

The Name and Address screen has been enhanced in the Partnership (1065), Corporation (1120), and S corporation (1120-S) returns. The DBA (Doing Business As) field has been moved up on the screen so the information shown in this field will be printed below the legal name of the partnership or corporation within the View/Print mode of the return, as well as various other forms, such as the Schedule K-1.

The DBA field is optional, and is not required by the IRS, but can be used if it fits the client's needs. If there is not a separate DBA name, this field can be used as a name continuation line, if necessary. Not all federal forms accept the DBA name, in which case, only the legal name of the corporation or partnership will be printed.

Important Generally speaking, the DBA field does not carry through to state returns. Only the information entered in the Legal Name field will be accepted on these state returns, unless an additional DBA name field is available within that specific state.

For example, the CA 100-S has a DBA field on Schedule Q, Line N which is populated by this federal entry field.