Drake Tax - 1120/1120-S: Entity Name Change

Article #: 15261

Last Updated: December 05, 2024

A corporation or s-corporation changing its name does not need to file a form with the IRS prior to filing its tax return for the year in which the name change occurs. The 1120 Instructions and 1120-S Instructions both specify that:

"If the corporation changed its name since it last filed a return, check the “Name change” box. Generally, a corporation also must have amended its articles of incorporation and filed the amendment with the state in which it was incorporated."

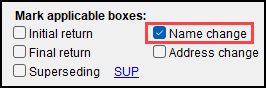

In Drake Tax, enter the Corporation's new legal name in the Corporation's legal name field on screen 1 Name, Address, General Info and check the box Name Change under the General Information section:

When this box is marked, the IRS will recognize that the name is different than in prior years and will update the name control in their database for future filings.

Extensions

If filing an extension for an 1120 or 1120-S return that changed its name during the year, the 7004 extension form must be filed using the name that is on file with the IRS and not the new name that will be used going forward. You can still enter the new name on screen 1 of the return and mark the Name change box, however, the previous name must be entered on the 7004 screen in the Prior Year Legal Name of Entity field (1120) or by using the Prior Year Legal Name of Entity link (1120-S). This will allow Drake to generate the required name control for the e-filed extension.

Caution If the Name change box is marked on screen 1, and the extension is being filed, error 1390 will generate until the prior name is entered on screen 7004. This will prevent IRS reject R0000-900-01.