Networking - Peer-to-Peer Data Locations

Article #: 11079

Last Updated: November 03, 2025

Data Locations screen selections on the workstations in a peer-to-peer network determine the extent to which the workstations use (or share) the resources of Drake Tax installed on the workstation designated as the "server." Shared resources are easier to manage because they result in more consistent appearance and functionality of peer-to-peer Drake Tax installations. This sharing method can impose a burden on the server. If network performance is slow, upgrading the server or reducing the level of shared assets may improve it.

In the example below, Drake Tax is installed on all networked computers. One workstation is designated as the "server" and the other workstations share functions with Drake Tax on the server. The designated server drive is shared on the network. This server drive will have Drake Tax installed directly on it. The shared drive is named on all workstations, and all workstations are mapped back to this main shared drive.

Note After you have installed Drake Tax and have begun using it, Drake Software recommends that you change data locations only under the direction of Drake Software Support. It is also advisable to make a backup of your current files to prevent loss of data. Call (828) 524-8020 for assistance.

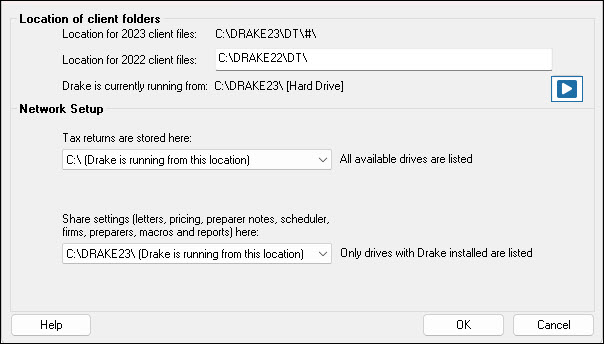

The setup on the designated server is the same as a default standalone setup. In this example, the version of Drake Tax installed on the server behaves like a standalone installation. This means that the current client files, settings, prior year client files, and prior year settings are all located on the C drive.

This is how the Data Locations setup would appear on the server computer:

Workstation Setup

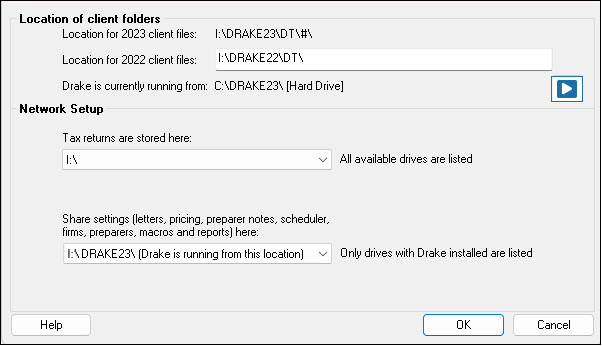

Workstations on the network also can use (or share) the resources of the server, to an extent determined by Data Locations settings in Drake Tax installed on the workstations. In this example, all workstations will use the same Data Locations settings, which will also share the listed functions. This is how the Data Locations setup window would appear on the workstations:

Important Some functions cannot be shared between workstation and server. These functions always run from the Drake Tax installation in which you are working:

-

All update functions - Each workstation must be updated separately.

-

State software - State software must be installed on the workstation. It cannot be run from another location.

Location for Current-Year Client Files

This field isn't editable and is set by the selection in the field Tax returns are stored here. It shows the path to the current year client file location, in this example within the Drake Tax installation on the server. It's important that all workstations and the server share the same set of current-year client files.

Location for Prior-Year Client Files

This is the path from the workstation to the location of last year's client files. In the example, they are in last year's Drake Tax installation on the server. Workstations use this path for functions that require prior-year return information, such as updating client returns, updating settings and preparing organizers. The Drake Tax server installation is not involved in workstation access to the previous years files, but it's important that the server and all workstations share the same set of prior-year client files.

Tax Returns are Stored Here

This is the location of current year client files. This selection determines the path shown in the Location for 2025 client files field. In the example, the I drive is selected, and the path shown in Location for 2025 client files is the path to Drake Tax on the designated server. In the example, this selection allows the workstations to share functions with Drake Tax on the server involving these data files:

-

Tax returns

-

Print files

-

EF database.

If a drive is selected where Drake Tax is not installed, the software would create a Drake Tax folder with only those sub-folders necessary to the shared functions (it does not install Drake Tax).

Share Settings

This selection allows the workstations to share all other functions capable of being shared with the selected Drake Tax installation. In the example, the workstations share with Drake Tax on the server. The drop list for this selection includes only drives where Drake Tax is actually installed. In the example, shared functions include:

-

Sets, and essentially all per form settings such as print form order (pricing file)

-

List of recent returns

-

Scheduler

-

Mail settings

-

Main settings - all setup options (screen colors, for example), custom reports and all report filters, letters, macros, prep info, firm info, CSM custom statuses (CF folder).

Troubleshooting

Current-year path problems:

-

A return is not in the path, so when you try to open it you are prompted to update or to create a new return. Other Drake Tax functions cannot find the return. If you know you previously created the return, it may be on another data path.

-

A return is in the path and you can open it, but data in the return suggests it is an earlier or later version than you expect. Data you previously entered may be missing or changed. The return you remember may be on another data path.

Prior-year path problems:

-

A return is not in the path, so trying to update it generates an error and the software offers to create a new return. Other Drake Tax functions, such as organizers, cannot find the return. If the return was created last year, it may be on another prior year data path.

-

A return is in the path and you can update it, but the updated data is not what you expect. The return you remember may be on another prior year data path.

Data paths are displayed on the Data Locations screen at Setup > Data Locations. You must log in with admin privileges to modify a path.

Data Paths in Drake Tax

Current Year

-

The Location for 2025client files is the current year path, which is set by the drive selected in the Tax returns are stored here field. The default path is C:\Drake25\DT\#\ (the drive Drake Tax is running from).

-

To modify this path, select another available drive in the Tax returns are stored here field. Drake Tax shows the drive path as the Location for 2025client files. Drake Tax creates the folders needed for the client files if they do not exist on the selected drive.

-

You are not prompted about the current-year path when entering or leaving the Data Locations screen. The path is always valid because Drake Tax creates it if it doesn't exist when you set the path. The software does not revert to the default current-year path.

Prior Year

-

The Location for 2024 client files is the prior year path. It defaults to C:\Drake24\DT\#\ (the drive Drake Tax is currently running from). To modify it, enter the full path, e.g. Z:\Drake24\DT\#\.

-

You may be prompted about an invalid prior-year path. If you enter a path (other than the default path) to a folder that does not exist, the software prompts you when you click OK. If you set an invalid path and exit the Data Locations screen, it reverts to the default path the next time you reenter the screen.