Drake Tax - 1040-NR: Amending Form 1040-X

Article #: 14064

Last Updated: December 05, 2024

If Suppress federal/state EF and all bank products is selected on screen EF (EF Selections) or Suppress federal EF is selected from Setup > Options > EF tab, only demographic information (name, address, SSN) is produced on page 1 of the 1040-X when completing for Form 1040-NR, and the remaining lines on Parts I and II of Form 1040-X remain blank. An explanation of changes should be entered in Part III. The changes are then reflected on the new or corrected 1040-NR return in the View/Print mode with the literal "AMENDED"printed at the top of the form.

Per the 1040-X Instructions:

"Resident and nonresident aliens. Use Form 1040-X to amend Form 1040-NR or Form 1040NR-EZ. Also, use Form 1040X if you should have filed Form 1040 (or, for years before 2018, Form 1040, 1040A, or 1040EZ) instead of Form 1040NR or 1040NR-EZ, or vice versa.

If you are paper-filing Form 1040-X for Form 1040NR or 1040NR-EZ, do the following:

Enter your name, current address, and social security number (SSN) or individual taxpayer identification number (ITIN) on the front of Form 1040X.

Don’t enter any other information on page 1. Also, don’t complete Parts I or II on page 2 of Form 1040X.

Enter in Part III the reason why you are filing Form 1040X.

Complete a new or corrected return (Form 1040, Form 1040NR, etc.).

Across the top of the new or corrected return, write “Amended.”

Attach the new or corrected return to the back of Form 1040-X

Note If you are electronically filing Form 1040-X to amend Form 1040-NR, you must complete Form 1040-X in its entirety. In years prior to Drake Tax 2021, only the demographic information, explanation of changes, and pages 1 and 2 contain 0's (zeros).

For more information, see Publication 519.

For instructions on how to amend a 1040 series return in Drake Tax see Related Links below. For a demonstration, watch the video Amended Return.

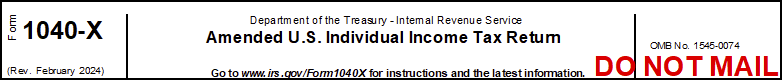

Why is there a "DO NOT MAIL" literal on Form 1040-X for Form 1040-NR? How do I get rid of it?

The "DO NOT MAIL" literal was added to amended 1040-NR returns in Drake Tax 2021 to help prevent duplicate e-filing and paper filing of Form 1040-X for 1040-NR returns. To remove this literal, navigate to screen EF (EF Selections), and mark the check box Suppress federal/state EF and all bank products.