Drake Accounting - Creating a Second 1098/1099 for the Same SSN/EIN

Article #: 16017

Last Updated: December 05, 2024

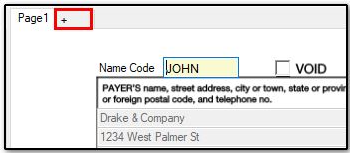

When entering information on-the-fly, to generate a second 1098 or 1099-MISC for the same individual or business (using the same SSN/FEIN) that is either for a State Copy or for a separate filing, click the + tab on top of the window. The following example uses Form 1099-MISC, however, other forms also use this same process.

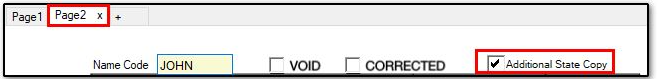

This will allow you to generate additional copies or enter additional amounts, without creating a second entry. This will also ensure that the two 1099 Forms are linked together properly and show as needed on Form 1096 and other summary reports.

For Form 1099-MISC:

If the second 1099-MISC is a state copy, be sure to check the box Additional State Copy. This will default all amounts from Page 1 on the Page 2 lines. Changes made to lines 1-15b on Page 1 will alter Page 2, and vice versa, if this is checked. State info will not be overwritten since the copy is for additional state information.

If it is not for an additional state copy, leave the box Additional State Copy unchecked and enter amounts as needed for the second 1099-MISC form.

See the 1099-MISC instructions for details on generating and filing Form 1099-MISC.