Drake Tax - Transmitting Check Print Records and Cashing the Check

Article #: 10180

Last Updated: November 03, 2025

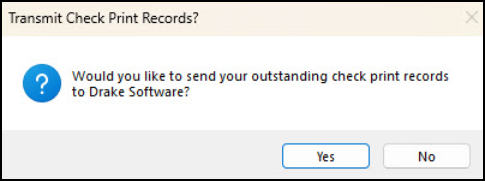

A check print record is automatically sent to Drake Software by default, unless the option Enable prompting before automatic transmission of 'Check Print Records' on Setup > Options > EF is marked. When that is selected, the following pop-up displays after printing a check:

You must click Yes. If you click No, the check print record will not be sent and the taxpayer may not be able to cash the check.

If the taxpayer is not able to cash the check, contact Drake Support at (828) 524-8020.

Check Register

A detailed check register can be printed from the Check Register dialog box. To access this option, select EF > Check Register and follow the steps below:

-

Select the Starting Date and Ending Date from the drop calendars. This date range includes the checks ready to print.

-

Select the Firm check register to print.

-

Click Continue to produce the register.

-

View and verify the information ready to print. The check register report displays the Check Number, Date, Amount, EFIN, Sequence, SSN, and Client Name for your review.

-

When you are satisfied with the review, click Print.