Drake Accounting - Converting from Dillner's Software

Article #: 15547

Last Updated: December 05, 2024

You can import Forms 940 and Forms 941 from Dillner’s software into Drake Accounting.

When you export your information in Dillner’s, it will create a .txt file that you will then import in Drake Accounting.

As a result, this will generate 94x forms that are ready to be transmitted, which can be seen under e-Filings > 94x > Transmit 94x Forms. Additionally, the import process allows you to print or save the 94x forms, and it creates 94x e-Files under e-Filings > Manage e-Files based on the information being imported. If applicable (refer to step 7), the clients associated with these e-Files will then show up in the Client Selector, and you will be prompted to complete the Client Setup, if needed. See below for more details about this process.

After you have completed the exporting process in Dillner’s, you are ready to import into Drake Accounting.

-

In Drake Accounting, go to File > Import.

-

Select Import Dillner’sTax.

-

Click the folder icon to browse to the location where you saved the .txt file that was created during the export process in Dillner's software.

-

Select the file.

-

Click Open.

-

-

Check the box for 940 or 941.

-

Click Import.

-

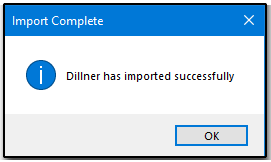

When the process is complete, you will see the message displayed below:

-

To verify that the 94x e-Files were created, go to e-Filings > Manage e-Files.

-

If you imported a .txt file that has less than five (5) 94x forms:

-

DAS will attempt to create clients from the information being imported.

-

As a result, the 94x e-Files will appear under the associated client

-

If this process is unsuccessful, an error message will display and explain what went wrong. This could be a result of selecting an invalid .txt file that does not follow the correct format.

-

-

If you imported a .txt file with five (5) or more 94x forms:

-

The 94x forms will appear under the default client that is currently selected in the Client Selector upon opening the software.

-

-

-

To transmit the 94x forms, go to e-Filings > 94x > Transmit 94x Forms > and select either 940 or 941.

-

Select the files to transmit.

-

Click Transmit.

-

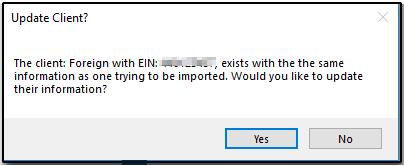

Importing a client that already exists in Drake Accounting

If the client already exists in Drake Accounting, a message will pop up asking if you wish to update client information when you go to File > Import and select the appropriate .txt file.

-

Clicking Yes will update the existing client’s information with the imported client’s information.

-

Clicking No will not update the existing client’s information, but it will still generate a 94x forms.