Drake Accounting - Exporting to Drake Tax Software

Article #: 15053

Last Updated: December 05, 2024

This feature exports information from Drake Accounting to the client’s tax return in Drake Tax Software for the tax year for which Drake Accounting bookkeeping has been maintained. Drake Accounting 2021, for example, would export to Drake Tax 2021 for tax year 2021. If a tax return for the client does not exist in Drake Tax, information from Client > Edit > Client Setup in Drake Accounting is used to create the tax return in Drake. If a tax return for this client exists in Drake, the EIN/SSN is used as the identifier for the client file and Drake Accounting exports to the existing tax return.

Caution If a tax return was prepared in Drake for the client last year, the client’s information must be brought forward from the previous year before exporting Drake Accounting data to Drake. In Drake, go to Last Year Data > Update Clients 20XX to 20YY. Enter the client’s EIN or SSN, click Add Client, then follow the instructions.

Complete the following steps to select the client data to export:

-

Go to Client > Edit > Business Information tab, and verify that the business type has been selected from the Business Type field.

-

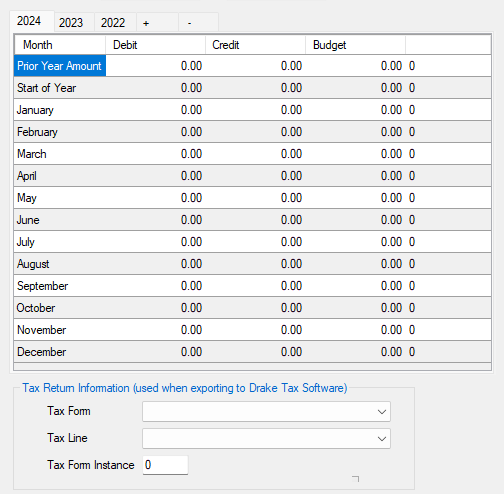

Go to Accounting > Chart of Accounts. Double-click a level 0 account number to export. Only level 0 accounts are used for this option.

-

Use the Tax Form drop list to select the form for this action.

-

Use the Tax Line drop list to select the line on the tax form.

-

Use the Tax Form Instance field to specify which instance of the form specified in the Tax Form field should receive the exported account information.

-

Click Save. Follow the procedure for each account number exported.

Complete the following steps to export the client data:

-

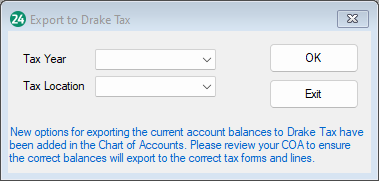

Go to Client > Export to Drake Tax.

-

Use the Export to drop lists to identify the location where Drake Tax Software is installed and the tax year.

-

Click OK. The export moves data from that account number in Drake Accounting to the form and line you have specified.

No worksheets or schedules are generated in the tax return, so these may need to be created to support the information imported (such as the Other Deductions line on tax returns). When multiple accounts in the Chart of Accounts are imported to the same form and line in the tax return, only totals are indicated on the return and overflow sheets are not generated.

Caution Export to Drake prior to performing the Year End Close. Do not run the Year End Close from Accounting > Year End Close prior to exporting. When you close the year end, zeroes are exported to Drake for those account numbers higher than the Retained Earnings account.