Drake Tax Online - Drake Tax Desktop Integration

Article #: 18787

Last Updated: January 29, 2026

With your purchase of Drake Tax Online, you have access to a customized version of Drake Tax Desktop. This version of Drake Tax must be used to access the following features and return types:

-

Traditional Data Entry

-

Keyboard shortcuts

-

Married Filing Joint (MFJ) Split Analysis & Return Splitting

-

K-1 Export Functionality

-

GruntWorx Integration

-

Interactive View/Print Mode

-

1120 returns

-

1041 returns

-

990 returns

-

706 returns

Tip For a demonstration, watch the video Drake Tax Online - Desktop Integration.

Note The Drake Tax Planner and Organizers are not currently available in DTO or the customized version of Drake Tax desktop.

If you want to create a new return, but open it directly in Drake Tax on your computer, follow the steps below.

Caution Before starting, make sure that you have already installed the customized version of Drake Tax on your computer.

-

Log in to your Drake Tax Online dashboard and launch the appropriate year of Drake Tax Online.

-

On the Tax Return Dashboard, click Create return on the right.

-

Select the applicable return type from the drop list.

Note In Drake Tax 2024 and prior, only 1040, 1120-S, and 1065 returns are able to be created in DTO.

In Drake Tax 2025 and future, you can create 1040, 1120-S, 1065, 1120, 1041, 990, and 706 returns in DTO (if purchased).

-

Enter and confirm the SSN/EIN.

-

Enter the client's name.

-

Click Advanced Options.

-

Choose Open with: Desktop as your preparation method.

-

Click the Create return button.

-

This will automatically open Drake Tax (Desktop) and take you directly into Data Entry mode for that client.

-

Make your entries or use the necessary features of Drake Tax desktop.

-

Your return will periodically be saved automatically as you work; however, you can also manually save using the Save/Sync button in the toolbar.

-

-

When you're done, click Return to Web in the menu to return to Drake Tax Online.

-

After returning to Drake Tax Online, you can review any changes made in Drake Tax desktop, add any final details or missing information, and e-file the return directly from the web.

Existing Return

If you want to work on an existing return using Drake Tax desktop, follow these steps instead.

Caution Before continuing, make sure that you have already installed the customized version of Drake Tax on your computer.

-

From the Drake Tax Online Tax Return Dashboard, locate the return in the list (or use the Find to search).

-

Click Launch in Desktop under Actions.

.png)

-

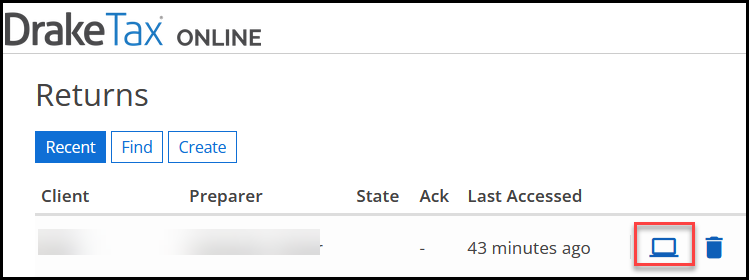

In DTO 2024, click the open in desktop icon instead:

-

-

This will automatically open Drake Tax Desktop and take you directly into Data Entry mode for that client.

-

Make your entries or use the necessary features of Drake Tax desktop.

-

Your return will periodically be saved automatically as you work; however, you can also manually save using the Save/Sync button in the toolbar.

-

-

When you're done, click Return to Web in the menu to return to Drake Tax Online.

-

After returning to Drake Tax Online, you can review any changes made in Drake Tax desktop, add any final details or missing information, and e-file the return directly from the web.

Mac and Linux Users

Mac and Linux users can use DTO, however, they would not be able to use features that are only available through the Drake Tax Desktop Integration as that version is subject to the same system requirements detailed in Drake Tax - System Requirements.

Feature Not Supported Message

You must always start or import a return while logged into Drake Tax Online. If you attempt to create or import a return directly from the Drake Tax Desktop integration, you will get the message: “This feature is not supported in this version of Drake Tax.” To proceed, log into Drake Tax Online to create or import the return. Then, if you prefer, you can launch Drake Tax desktop to proceed with your entries.

Related Links

Drake Tax Online - Creating a Return

Drake Tax Online - Conversions