Drake Tax Online - Conversions

Article #: 18788

Last Updated: January 30, 2026

If you used Drake Tax Desktop in the prior year, you can easily convert your client files to Drake Tax Online by following these steps:

-

Navigate to the folder where Drake Tax is installed on your PC (for example: C:\Drake\Drake23).

-

Open the Drake24 folder and locate the DT folder.

-

Right-click on the DT folder and select Compress to Zip File.

-

Log in to the Drake Tax Online dashboard.

-

Go to Tools > Client Files.

-

In the Import Client Files section, click I'm ready to upload my converted files.

-

Click I agree on the Conversion Agreement.

-

Choose either:

-

Import prior year files (Convert 2024 files for 2025)

-

Import current year files (Convert 2025 files for use in 2025)

-

-

Drag and drop the ZIP file that you created earlier into the upload area..

-

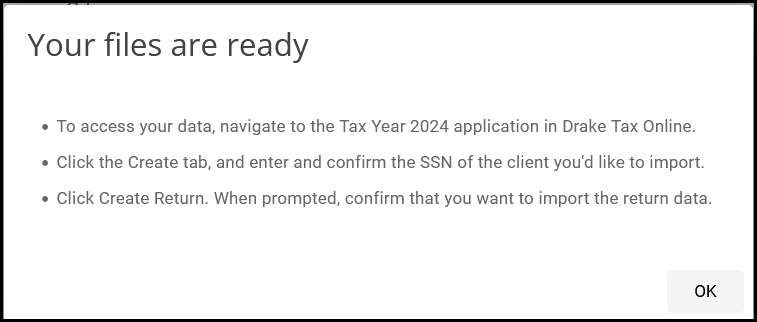

The system will process your files, and you will be notified when the conversion is complete.

-

Launch Tax Year 2025 in Drake Tax Online.

-

Click on the Create tab.

-

Enter and confirm the SSN or EIN of the client you’d like to import.

-

Click Create Return.

-

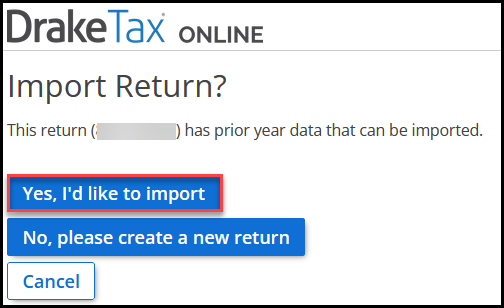

Click Yes, I'd like to import.

-

Once it is imported, the return will open with prior-year data carried over. The return will also appear in Search Results, Recent Returns, or similar areas for easy access.

From Any Other Program

Drake Tax Online uses the same conversion programs as Drake Tax Desktop (see Drake Tax - Conversion Program FAQs for details). Once you have converted the files from your prior software provider to Drake Tax Desktop, follow the steps above to move the converted data files into Drake Tax Online.

Frequently Asked Questions

Upload allows you to store files in Drake Tax Online, such as PDFs or Drake backup files. Uploading a file does not move any data into a return.

Import is the process of transferring data from a prior-year Drake return into a newly created return. Import pulls eligible taxpayer information and forms from a saved, calculated prior-year return.

Uploading a file alone does not make it available for import. The prior-year return must exist as a saved Drake return.

The import prompt only appears during the creation of a new return and only if Drake Tax Online detects an eligible prior-year return. If the prompt does not appear, one or more required conditions may not be met.

Common causes the import prompt may not appear:

-

Return already created - If the current-year return has already been created, the import prompt will not appear. Imports can only be completed at the time the return is first created.

-

No calculation in the prior year - The prior-year return must have been calculated. Returns that were never calculated are not eligible for import.

-

Business returns not enabled - Business returns can only be imported if business returns are enabled on the Drake Tax Online account. If business returns are not enabled, the import option will not appear for business clients.

-

File never saved in the prior year - The prior-year return must have been saved at least once. Returns that were opened but never saved cannot be imported.

-

Disclosure Entry - on Setup > ERO Setup, if you check the box My firm is part of a Franchise, Network, or Service Bureau and then make an entry in the box Consent is required to disclose tax return information to this franchise/network, there are limits to information that can be imported.

Drake Tax Online allows imports only during return creation to prevent overwriting existing data. Once a return is created, prior-year data cannot be imported into it. To import prior-year data, the return must be deleted and recreated, provided sufficient returns are available in the return bank.

In Drake Tax Online, each imported return is redeemed against your available bank of returns when the taxpayer’s SSN or EIN is entered and confirmed. Because each return counts individually, you must complete the import process separately for each return you want to bring forward from the prior year.

This requirement prevents a return from being redeemed for a client who may not be returning. By entering ID numbers one at a time, you control exactly which prior-year returns are imported and charged against your return bank.