Drake Tax - Auto-Install and Auto-Update

Article #: 18882

Last Updated: January 02, 2026

We’ve simplified the installation and update process for Drake Tax 2025. For most users, Drake Tax 2025 can be automatically installed when it is ready. Once you launch Drake Tax 2025, your settings from Drake Tax 2024 will be transferred seamlessly. This way, you’ll be ready for the new tax year without needing to manually handle program installation or setting updates.

Important This feature is not available for some multi-site offices.

In order to use Drake Tax 2025, you must have purchased a license. If you have not yet renewed, Drake Tax 2025 will be installed in trial mode.

If you use Rightworks, see Rightworks - Installing Applications for information about program installation.

For steps on manual installation, see Drake Tax - Installation.

Auto-Install Program

-

The installer automatically launches in the background when Drake Tax 2025 is available for download.

-

The available federal and state tax programs will be installed.*

-

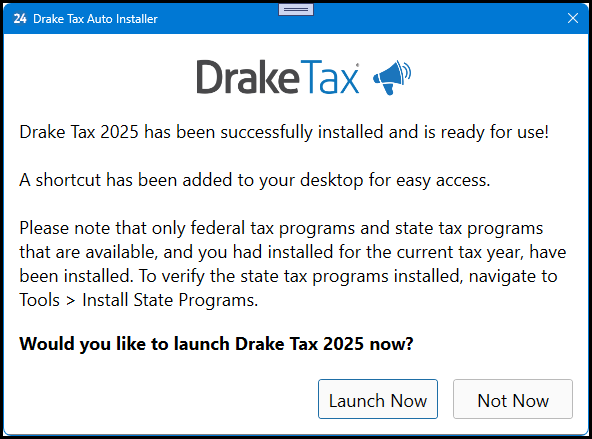

As soon as the installer finishes, you will see the following notice (and the Drake Tax 2025 shortcut will be added to your desktop).

-

Click Launch Now to open Drake Tax 2025.

-

If you click Not Now, the installer will close, and you can launch Drake Tax 2025 from your desktop icon when you are ready to start working in Drake Tax 2025.

-

Note *Drake Tax 2024 must be installed on this computer/network for the auto-installer to run.

States will only be installed if available. In addition, only those state programs that you had installed in Drake Tax 2024 will be automatically installed for Drake Tax 2025. You can install additional state programs from Tools > Install State Programs as needed (once released). See below for more info about the state installation update.

State Installation

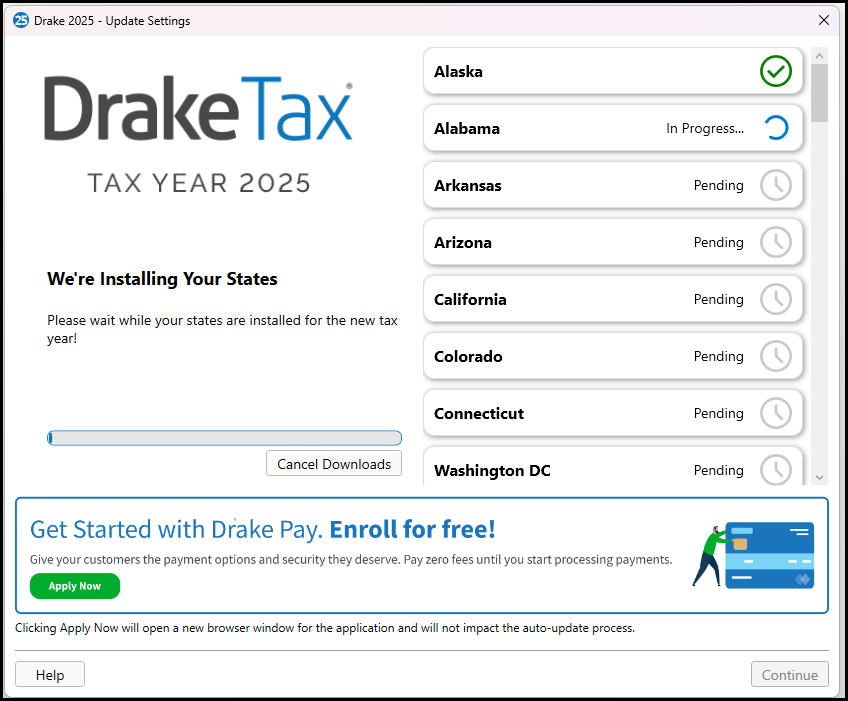

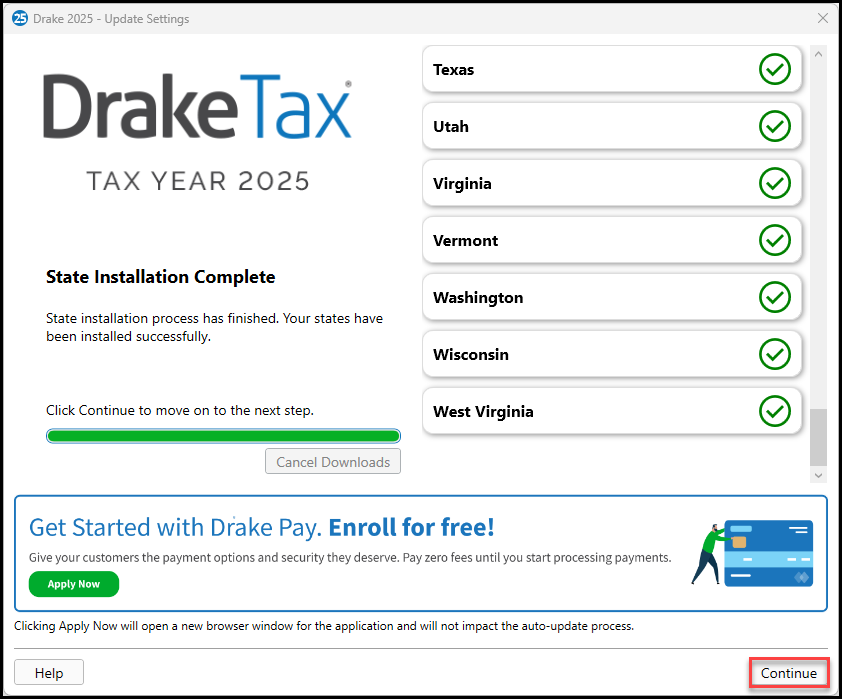

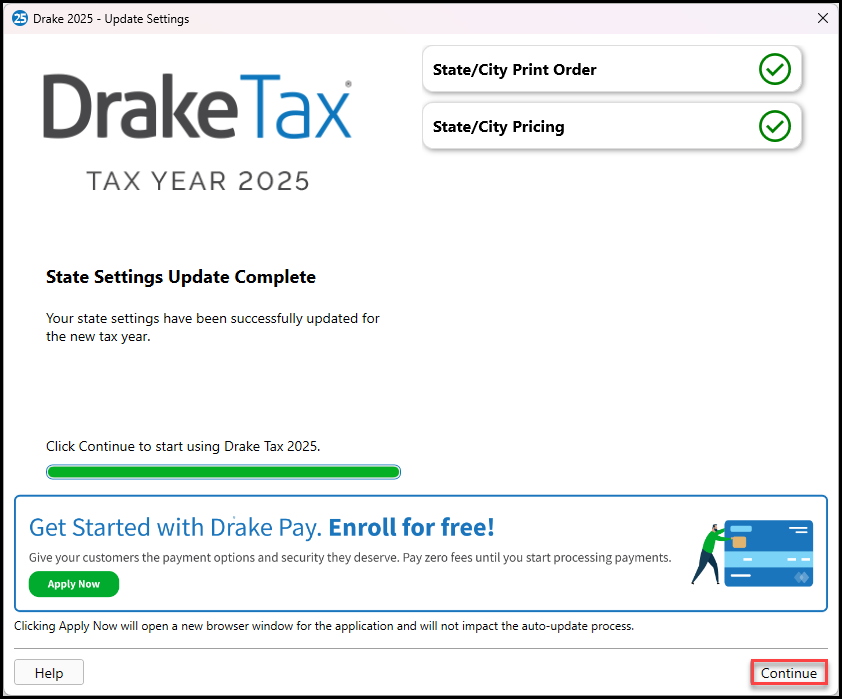

If your program auto-installed in December, the full version is now installed as part of our secure program update utility in January. When you log in, you will be prompted to install updates. Once the updater finishes, you will see the Update Settings window and your state programs will start to install. Click Continue when you see State Installation Complete.

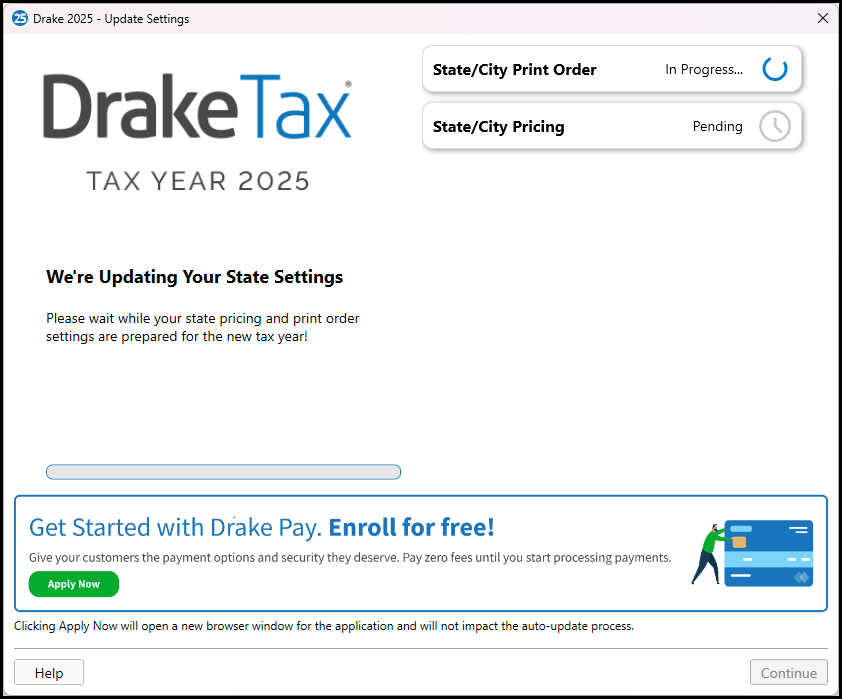

The state settings will then be updated. Click Continue when the update has finished.

Only those states that were used in Drake Tax 2024 are auto-installed. If you need to install additional states, go to Tools > Install State Programs after logging in.

Auto-Update Prior-Year Settings

The first time you open Drake Tax 2025, you will be prompted to agree to the license agreement and set up your administrator login. Then, your settings will start updating from Drake Tax 2024. See Drake Tax - Auto-Update Prior-Year Settings for details.