Drake Tax - Auto-Update Prior-Year Settings

Article #: 18904

Last Updated: December 08, 2025

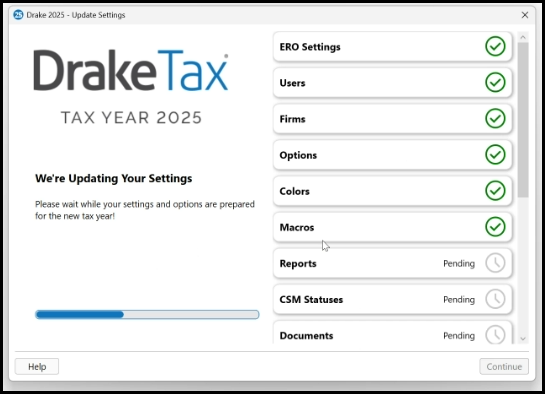

The first time you open Drake Tax 2025, you will be prompted to agree to the license agreement and set up your administrator login. Then, your settings will start updating from Drake Tax 2024. The window displays the actions that are being taken with an indicator showing that each setting type is complete.

-

Federal and programs settings and options are being updated:

Settings List shows the full list of settings that are updated.

-

Once the screen says Settings Update Complete, click Continue.

-

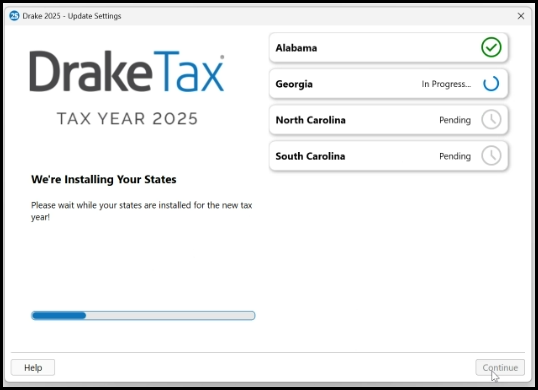

If state programs have been released, the update program will continue with state programs and settings updates below. Otherwise, when you click Continue, you will see the homepage of Drake Tax.

-

-

State programs are installed based on which states you had installed in Drake Tax 2024.

-

Once the screen says State Installation Complete, click Continue.

-

This step is not available until states are available for download.

-

-

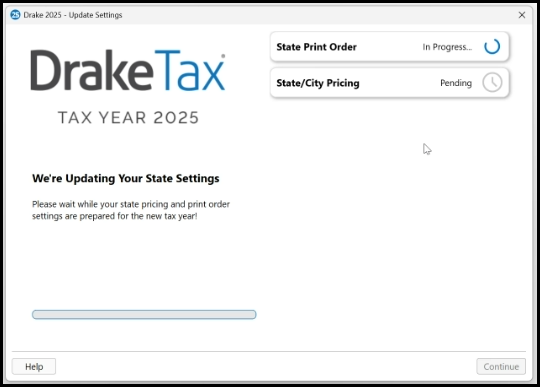

State-specific settings, including pricing and print order, are updated based on the prior-year info.

-

Once the screen says State Settings Update Complete, click Continue.

-

This step is not shown until state programs are available and have been installed.

-

-

We recommend that you go to Setup > Options and verify if any additional changes need to be made. Setup > Pricing is updated, but a percentage increase is not applied. If you want to apply pricing changes, you can do so at this time.

Tip User-level settings are also updated for each user automatically. There is no separate notification of this functionality. Users can edit their own settings as needed after updating.

Note The auto-updater will look at the same drive that Drake Tax 2025 is installed on first. If Drake Tax 2024 does not exist on that drive, the program will search for other drives that may contain Drake Tax 2024 and use those settings to update the Drake Tax 2025 program instead.

If you are running Drake Tax on a network, see below for additional steps that may need to be taken.

Networked Offices

If you are on an NW Client network, settings are updated based on the prior year setup. Simply confirm that all your settings and options were updated as expected, and make any additional changes as needed.

If you are on a peer-to-peer network, some settings will be updated during the auto-update process, however, you will need to manually update any settings that are stored on a shared drive that is different from the drive that Drake Tax was installed on.

-

Go to Setup > Data Locations.

-

Select the appropriate shared drive letter. Make sure that the correct drive letter is selected for the following:

-

Location for 2024 client files

-

Tax returns are stored here drop-list

-

Share settings drop-list

-

-

Then go to Last Year Data > Update Settings and choose any items that need to be updated from the network location.

See Network Setup and Networking - Peer-to-Peer Data Locations for more information.

Settings List

-

ERO Settings

-

Users

-

Firms

-

Options

-

Colors

-

Macros

-

Reports

-

CSM Statuses

-

Documents

-

Email Data

-

Federal Print Order

-

Organizer Print Order Federal Pricing

-

Letters

-

Scheduler

Drake Tax - Configuring a Firewall