Drake Accounting - UT - 33H and 33HA Wage Report

Article #: 16311

Last Updated: December 05, 2024

For filing to the Utah Department of Workforce Services (UDWS), DAS can produce:

-

For paper-filing in PDF format, the Utah Form #33H, Employer Quarterly Wage List and Contribution Report, and Form #33HA, Utah Employer Quarterly Wage List Continuation Sheet.

-

For e-filing, a .txt file for upload to the Utah Department of Workforce Services website.

To prepare the report:

-

Select the Employees or On the Fly menu, then select State Tax & Wage Forms.

-

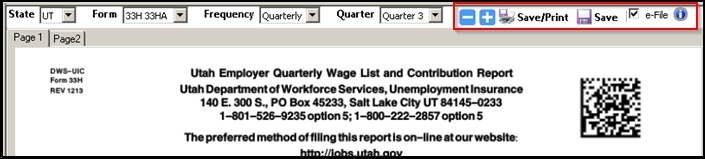

Make sure UT is selected, then select 33H 33HA from the Forms droplist.

-

Review the form and make any necessary entries or edits.

-

Make sure the e-file checkbox is marked (if e-filing), then select Save/Print.

Save/Print creates the PDF copy of the form and the .txt file for upload if e-file was selected.

To e-file:

-

Log in to the UDWS Unemployment Insurance and New Hire Reporting website.

-

Follow the menu options to upload the file.

-

The upload file can be found by browsing to the drive where DAS is installed >DrakeAccounting20YY > DAS20YYData (beginning in DAS2021) > Clients > client code > EFile > UT > UT33H33HA and selecting the file named UT33H33HA_YYYY-MM-DD_HR_MIN_SEC.txt (where YYYY_YYYY-MM-DD_HR_MIN_SEC is the date and time of file creation).

For more information about e-filing Utah wage reports, see the UDWS FAQs.