Drake Tax Online - Drake Portals Integration - Document Upload

Article #: 18933

Last Updated: February 02, 2026

When using Drake Tax Online, you can use Drake Portals to exchange documents securely and send the tax return for e-signatures.

This article discusses sending documents for review. See Drake Tax Online - Drake Portals Integration - e-Signatures for more detailed steps on sending signature documents.

After you have completed the Firm and Taxpayer setup (covered in Drake Tax Online - Drake Portals Integration - Setup), follow these steps to upload the return to the taxpayer's portal:

-

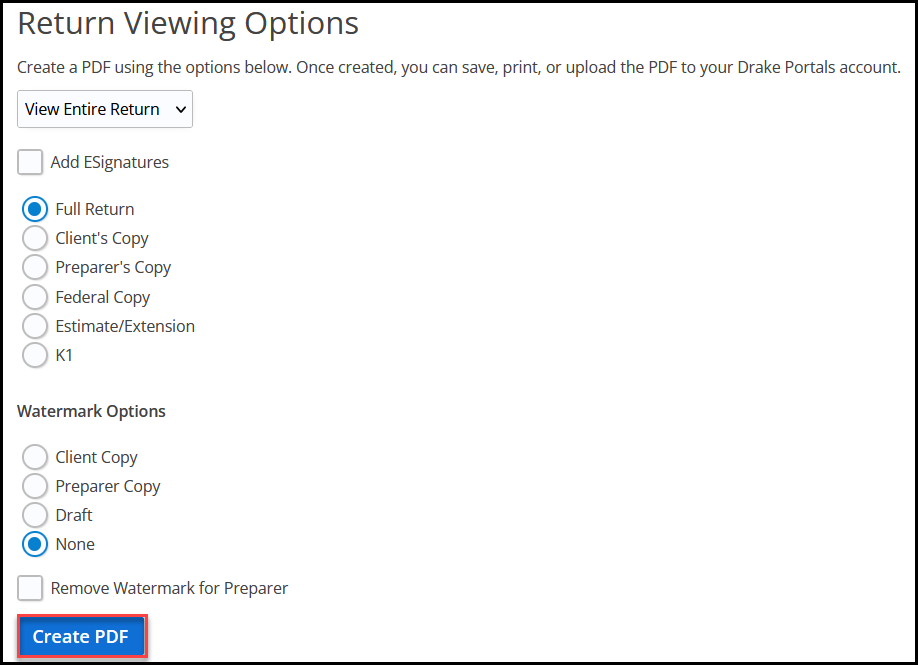

Open the return and click View Return.

-

Select the applicable options.

-

Check Add ESignatures (optional).

-

Click Create PDF.

-

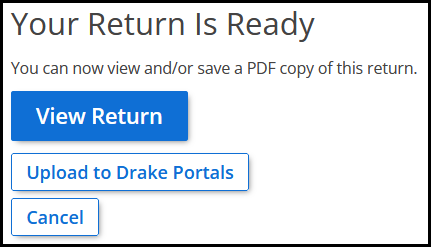

Click Upload to Drake Portals.

-

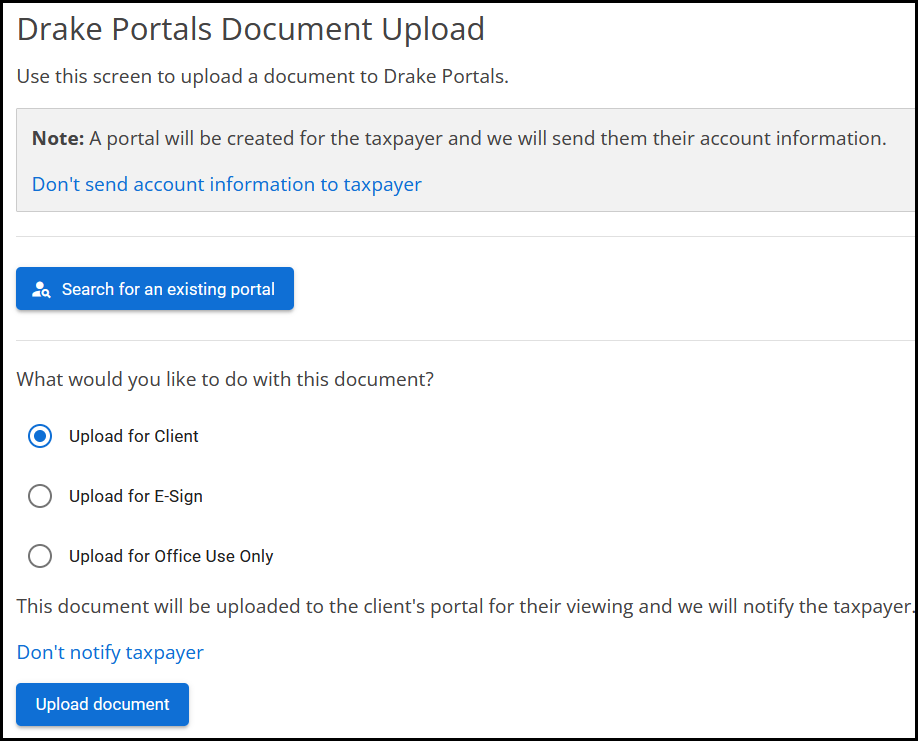

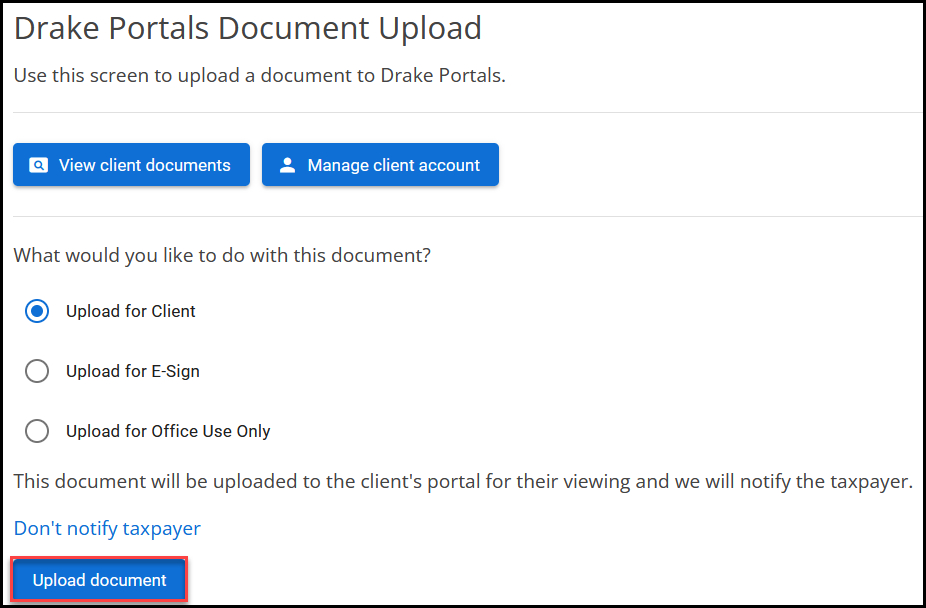

Select the applicable upload option and click Upload.

Note You can repeat the upload as many times as needed if you want to upload the same document for client, e-sign, and office use only. You can also toggle whether to notify the taxpayer of the upload.

Tip If a client portal has not been linked or does not yet exist for this taxpayer, you can link or create the portal during the upload (step 6 above). If you want to create a new portal, simply click Upload document and the portal will be created with the return information. Alternatively, click Search for an existing portal to link the client file with an existing portal, and then continue with the upload.