Drake Tax Online - Drake Portals Integration - e-Signatures

Article #: 18932

Last Updated: February 02, 2026

When using Drake Tax Online, you can use Drake Portals to send the tax return for e-signatures.

Note Signature pads are not supported in Drake Tax Online, either on the online site or in the Drake Tax Desktop integration.

This article discusses uploading e-signature documents. See Drake Tax Online - Drake Portals Integration - Document Upload for more detailed steps on sending other documents.

After you have completed the Firm and Taxpayer setup (covered in Drake Tax Online - Drake Portals Integration - Setup), follow these steps to upload the signature documents to the taxpayer's portal:

-

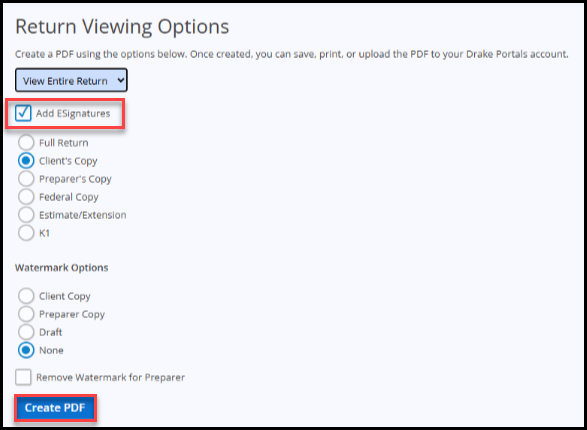

Open the return and click View Return.

-

Select View Entire Return in the drop list.

-

Check Add ESignatures.

-

Select the copy format (i.e., Client's Copy) and watermark options (if applicable).

-

Click Create PDF.

-

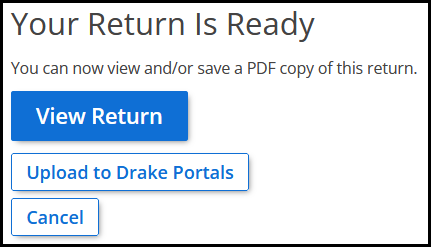

Click Upload to Drake Portals.

-

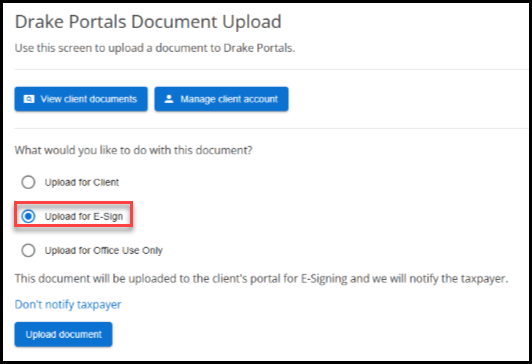

Select Upload for E-Sign radio button and click Upload document.

Taxpayer Steps

The taxpayer can sign the return using the steps listed in Drake Portals - Drake e-Sign Online (Taxpayer View).