Drake Accounting - Year End Close

Article #: 15889

Last Updated: December 05, 2024

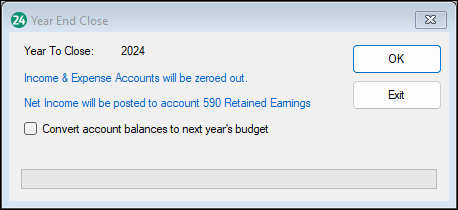

The Year End Close process, found under the Accounting module, zeroes out all income, other income, cost of goods sold, expense accounts and other expense accounts and posts net income to the retained earnings account. Run the Year End Close after the final period of the year has been posted. Include all adjustments in the final period as Drake Accounting does not offer a 13th adjustment period. If the client is not a fiscal year client, the Year End Close must be performed in order to bring the Chart of Accounts into the following year’s Drake Accounting program.

Important A year end close can be done with either Live Posting or Normal Posting. For Normal Posting, a Year End Close is not allowed if there are any unposted transactions. You must do a Year End Close for both Live Posting and Normal Posting before updating a prior year.

Prior to performing the Year End Close you must:

-

Perform the Post Transactions process (Accounting > Transactions > Unposted and click Post)

-

Export to the Drake Tax software program.

-

The information required for the export is not available after closing the year.

-

To post the Year End Close to the General Ledger:

-

Go to Accounting > Year End Close.

-

To convert account balances to next year's budget, click the check box.

-

Click OK.

Drake Accounting prepares the files for the new year.

Note All income, other income, cost of goods sold, expense and other expense accounts will be zeroed out. Drake Accounting backs up the active client's files prior to closing the year.