Drake Accounting - Paying Tax Deposits via EFTPS

Article #: 16423

Last Updated: December 05, 2024

Tax deposit information can be exported to and paid through the Electronic Federal Tax Payment System (EFTPS) Batch Provider Software. Watch the video Processing EFTPS Tax Deposits for a demonstration.

Note For each client you will be processing payments for, you must file Form 8655 and complete the Enrollment information in the EFTPS Batch Provider Software.

Setup

Both the firm and the client will require information to be entered in setup to utilize this function.

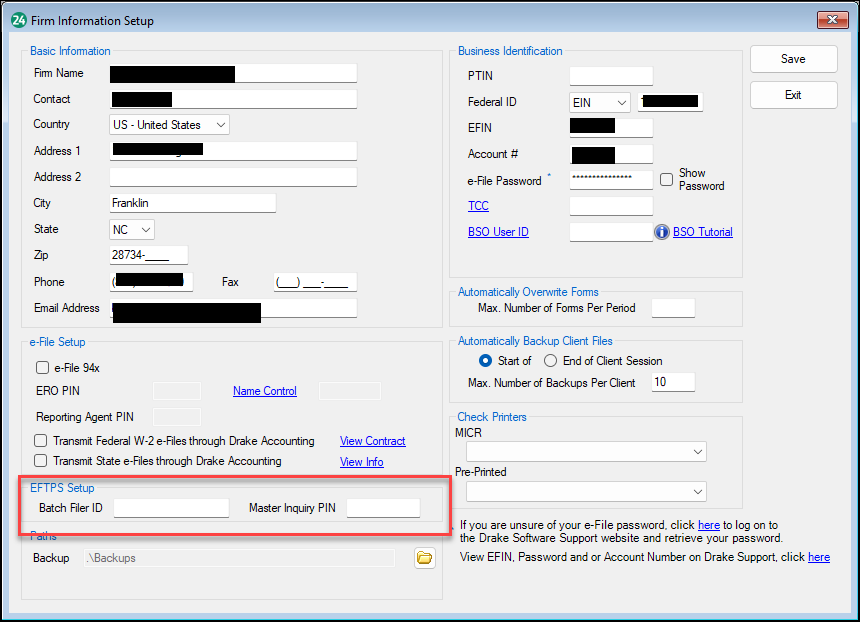

To set up the firm information:

-

Select the Firm menu, then select Firm Information Setup.

-

In the EFTPS Setup section, enter your Batch Filer ID and Master Inquiry PIN.

-

Select Save.

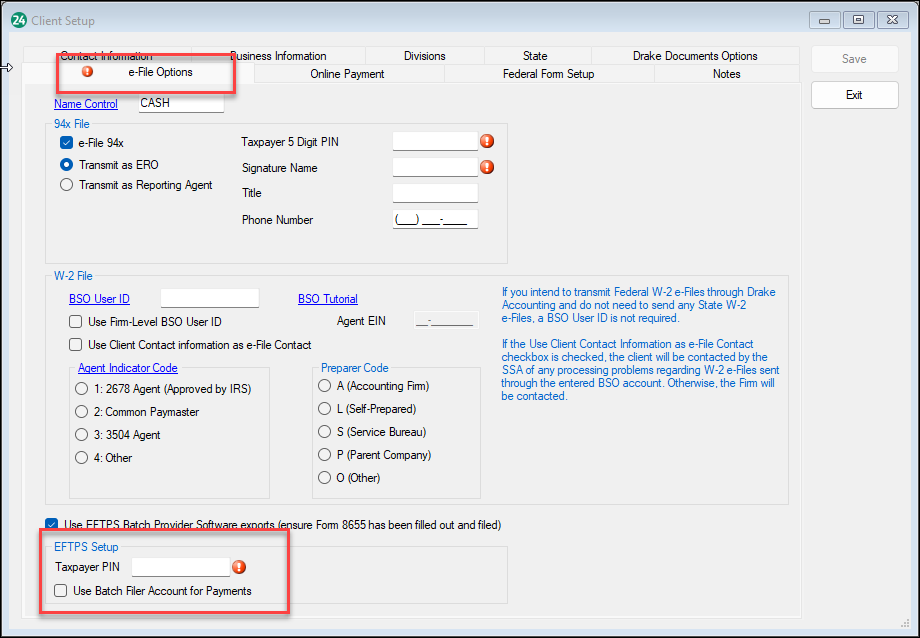

To set up the client information:

-

Select the Client menu, then select Edit.

-

Select the e-File Options tab.

-

Check the Use EFTPS Batch Provider Software exports checkbox.

-

Enter the Taxpayer PIN.

-

If applicable, check the Use Batch Filer Account for Payments checkbox.

-

Select Save.

Once the firm and client setup information has been completed, complete the Tax Deposit screen.

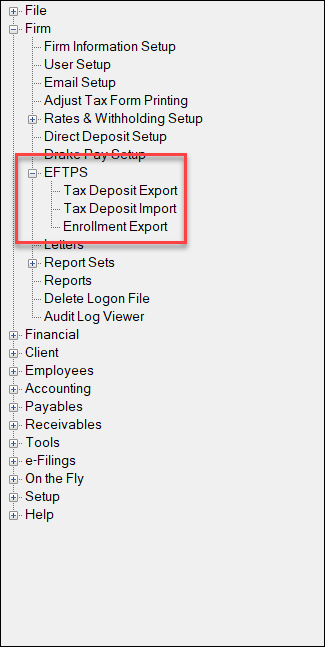

Enrollment Export

Enrollment information can be exported from DAS, then imported into the EFTPS Batch Provider Software. To export client enrollment information:

-

Select the Firm menu, then select EFTPS and Enrollment Export.

-

Select the desired client(s).

-

Select Export and save the .txt file to an easy to find location.

Tax Deposit Export

To export a client's tax deposit information:

-

Select the Firm menu, then select EFTPS and Tax Deposit Export.

-

Select the desired client(s).

-

Select Export and save the .txt file to an easy to find location.

-

Select Save.

See the EFTPS Batch Provider Software User Manual for instructions on importing the .txt file and exporting payment information.

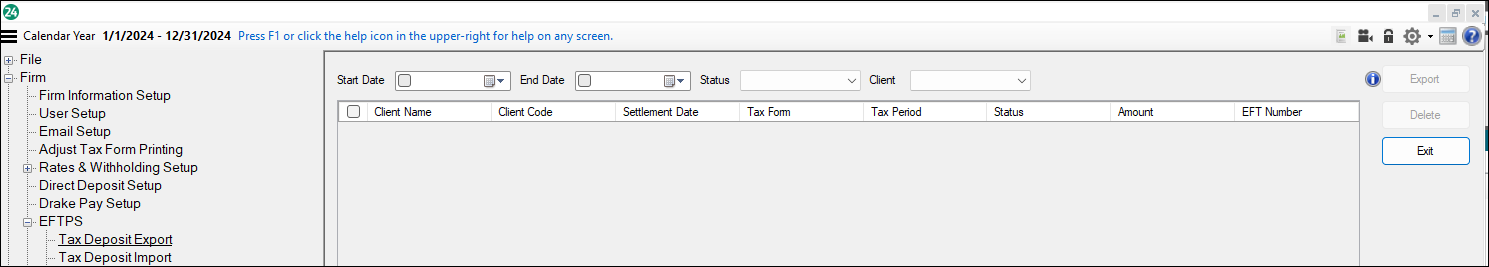

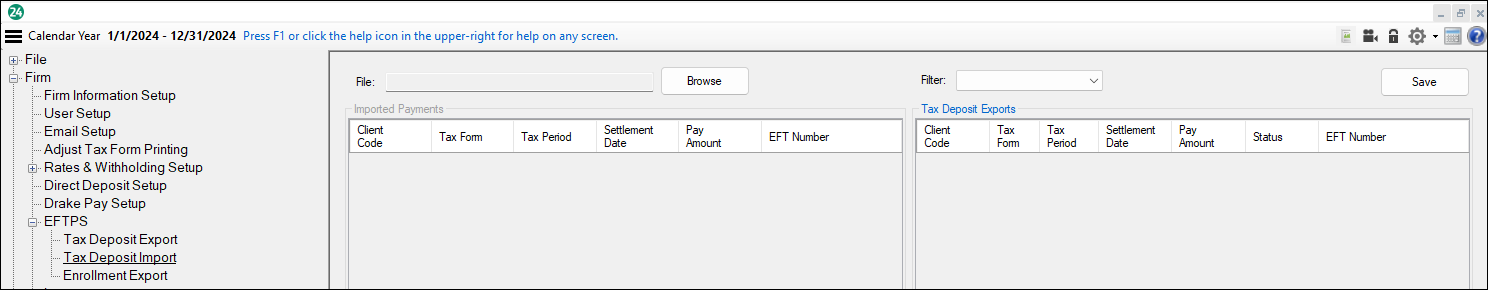

Importing Tax Deposit Payment Information

Tax deposit payment data can be imported from the EFTPS software to reconcile payments with the deposits recorded in DAS. To import a .csv file that was exported from EFTPS:

-

Select the Firm menu, then select EFTPS and Tax Deposit Import.

-

Select Browse, then navigate to the saved .csv file.

Once the .csv file is imported, the payment data and EFT Number (confirmation number) will populate on the left side of the screen. The tax deposit records in DAS will show on the right side, and the applicable EFT Number can be selected from the droplist to reconcile.

For more information see the EFTPS Batch Provider Software User Manual.