Drake Pay - Integration in Drake Portals

Article #: 18317

Last Updated: November 03, 2025

Client payments may be submitted online through Drake Portals only if the preparer has an active Drake Portals subscription and is partnered with Drake Pay. The Drake Pay service requires additional fees. See Drake Pay and Drake Refund Pay - Application Process for details on signing up for Drake Pay. See Drake Portals - Overview and Pricing for details on signing up for Drake Portals.

To bill a client for tax preparation directly through the Drake Portals website:

-

Log in to Drake Portals.

-

Select the client from the list or create a new client by clicking Add.

-

Click the Payment tab.

-

Under Submit Bill, enter the amount and a memo (optional).

-

Click Send to send the bill amount to the taxpayer.

-

The client will receive a notification email that a bill has been sent.

-

When they log in to their Drake Portals Account, they click on Payment on the left.

-

From this section, the taxpayer will click on Pay and then enter in their credit card information and submit the payment.

-

-

Once completed, you can verify the payment, make changes, or print documentation by clicking on the transaction in the list.

Drake Documents Integration

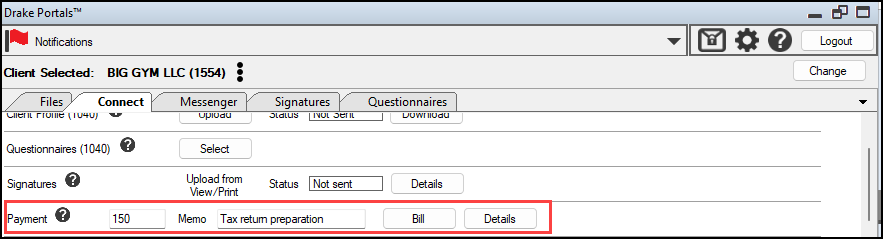

To bill a client for tax preparation directly from theDrake Portals pane > Connect tab inside Drake Documents:

-

On the Connect tab, enter the Payment amount. Enter a Memo describing the charge, if desired.

-

Click the Bill button to send the bill to the taxpayer.

-

The client receives an email, notifying them that they have a bill to pay.

-

When they log in to their Drake Portals account, the client navigates to Payment > Pay,enters their credit or debit card information, and submits the payment.

-

-

Once the client has paid their bill, you can review payment details by clicking the Details button.

Note If the taxpayer does not have one or more of the tabs available in Drake Portals, check the Connect Features tab located in Drake Portals > Account Settings to review what features have been enabled for your clients (global setting).

Taxpayers cannot make partial payments on their bill; only the total amount that you send is able to be paid. If the taxpayer would like to pay in installments, you will need to make changes to the bill amount or send them multiple bills.

The payment information is not automatically imported into the return. Once notification of payment is received, the payment needs to be manually entered on the BILL screen in the client return.