Drake Pay and Drake Refund Pay - Check Payment Request Status

Article #: 18682

Last Updated: February 27, 2026

To check the status of a Drake Pay or Drake Refund Pay payment using Drake Tax, follow these steps:

-

Open the return in Data Entry.

-

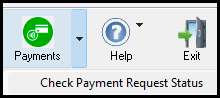

Click the black arrow beside Payments and choose Check Payment Request Status:

-

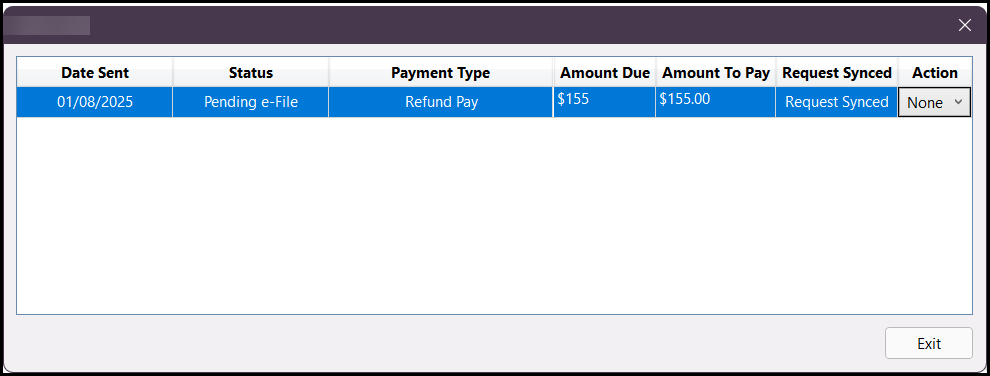

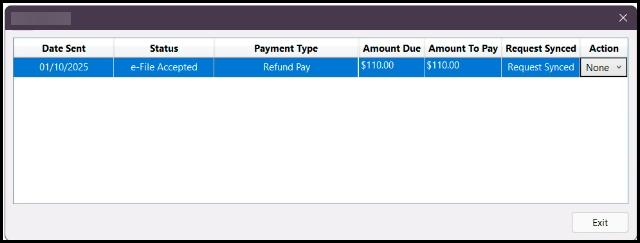

The status window displays payment details:

-

One of the following is shown in the Status Column:

-

Sent - A payment request was sent to the customer for review.

-

Paid - The customer has paid the invoice using a Credit or Debit Card.

-

Cancelled - A payment request was sent, but it was cancelled prior to payment.

-

ACH Initiated - The customer completed the ACH payment option in their payment portal.

-

In Progress - The customer completed the ACH payment option, and the ACH transaction is being processed.

-

Pending ACH - ACH has been processed, but has not yet cleared.

-

ACH Complete - The customer completed the ACH payment option, and the ACH transaction has been completed..

-

Unable to Complete Payment - The customer completed the ACH payment option, but it was unable to be completed. The taxpayer should contact their bank for more information.

-

Payment Failed - The customer completed the ACH payment option, but the payment was not able to be deposited into the preparer's account. The preparer should contact their bank for more information.

-

Pending e-File - A payment request was sent, the taxpayer selected the Drake Refund Pay option, but the return has not yet been e-filed.*

-

e-File Accepted - A payment request was sent, the taxpayer selected the Drake Refund Pay option, and the return has been accepted by the IRS.*

-

-

From the Actions drop list, you can choose:

-

None - Default selection, no actions are taken.

-

Sync Request - Checks to see if any updates have been made to the payment status.

-

Cancel - Cancels the payment request. This action is not always available; see below for details.

Note

When the status shows Pending e-File, we recommend that you review the Drake Refund Pay information that is carried to the return. Review the RFPY Bank Documents in View/Print mode to ensure that all banking information, fees, etc. are showing as expected. The Transaction Summary will also show this information.

-

-

Click Exit when you are done.

Cancel a Payment

Some payments cannot be cancelled:

-

If the payment Status is Paid, e-File Accepted, ACH Initiated, In Progress, or ACH Complete it cannot be cancelled.

-

If the payment Status is Pending e-File, it can be cancelled, however, this also removes Drake Refund Pay from the return.

-

If the payment Status is Sent, it can be cancelled.

After cancelling, you would need to send a new payment request. At that time, the taxpayer can choose to pay by Debit or Credit Card, or complete the Drake Refund Pay application. See Drake Pay - Payment Requests - Taxpayer View or Drake Pay - Drake Refund Pay for details.

*The statuses of e-File Accepted and Pending e-File are only used for firms who have been approved to offer Drake Refund Pay. See Drake Refund Pay - Overview and FAQs for details.

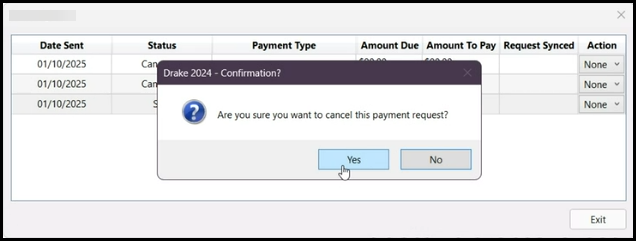

If you choose Cancel in the Actions drop list, it will ask you to confirm your selection:

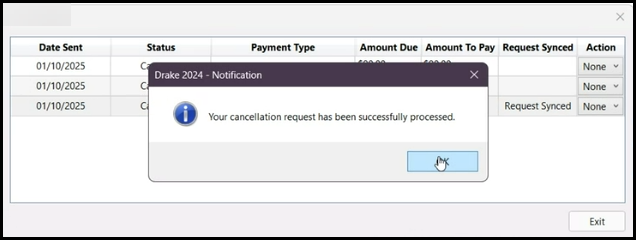

If you click Yes, you will see a notification that the payment request has been canceled.

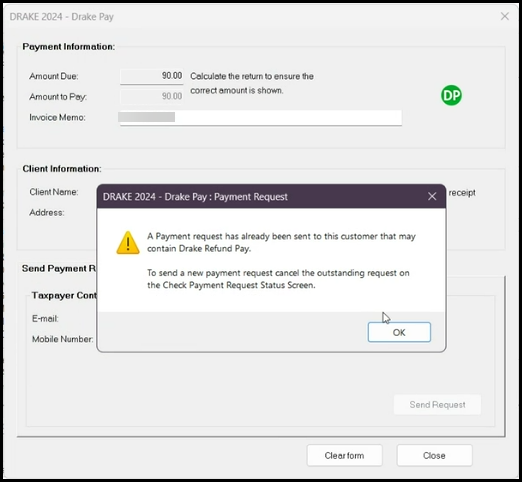

Request Already Sent Message

If you have already sent a payment request to the taxpayer, you will see the following message when you click on the Payments icon. You cannot send an additional payment request. If you need to change the payment amount, you must cancel the outstanding payment request first. Then you will be able to send another request.