Drake Pay - Payment Requests - Taxpayer View

Article #: 18662

Last Updated: November 03, 2025

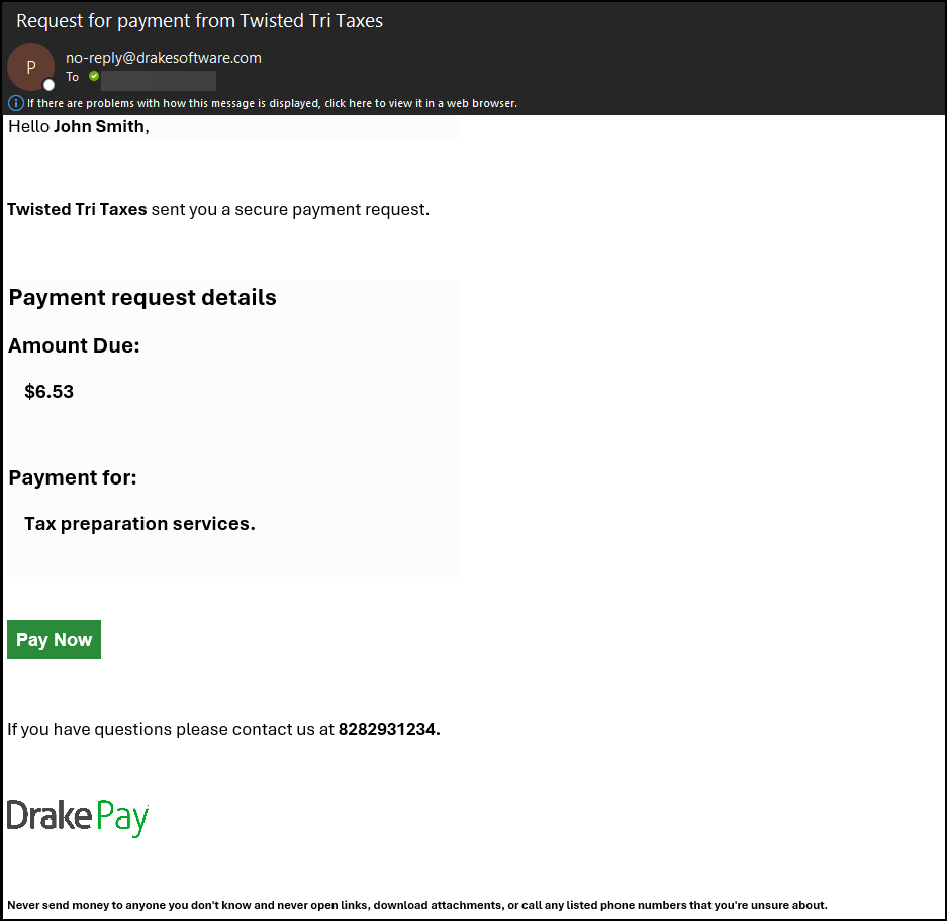

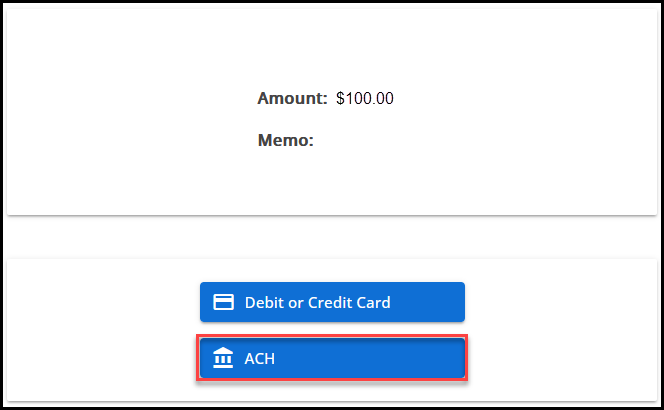

When your tax preparer sends you a payment request, you will receive an email with a link to Pay Now. When you select Pay Now, you are redirected to the Drake Pay payment portal where you can choose either Credit or Debit Card or ACH*.

Important Beware of phishing scams! For details on what authentic Drake Pay emails and web pages look like, and for tips on how to stay safe, see Drake Pay - Phishing vs. Legitimate Emails.

Preparers should review Drake Pay - Sending Payment Requests instead.

-

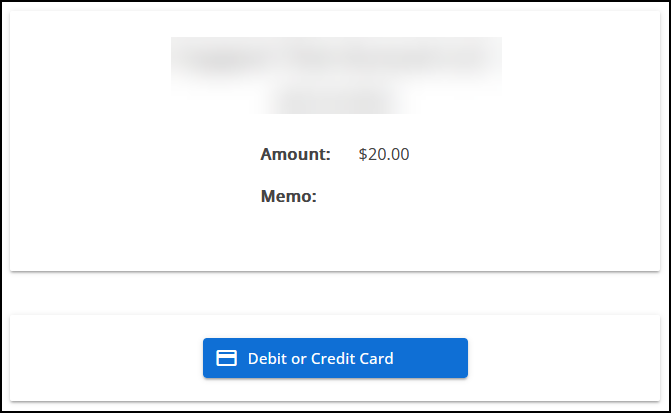

If you want to pay using a credit or debit card, in the Drake Pay payment portal, click the Debit or Credit Card button.

-

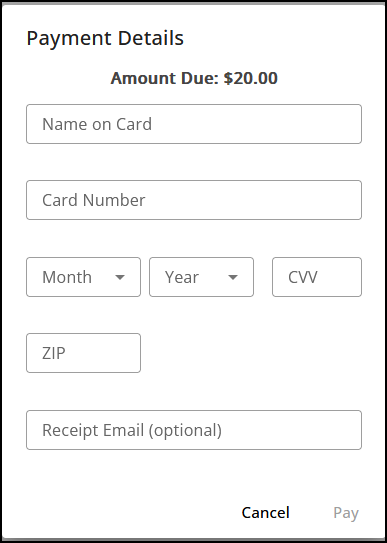

Enter your card details and click Pay. If you enter a Receipt Email, you will receive a PDF receipt of the transaction via email.

-

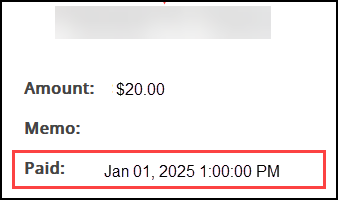

Once the payment is successful, your bill shows as Paid any time you return to the Pay Now link.

ACH Payment

Note *ACH payments may not be available for all invoices.

-

If you want to pay using your bank account, in the Drake Pay payment portal, click the ACH button..

-

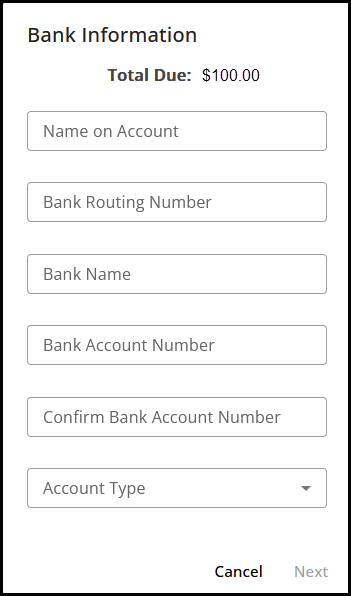

Enter your Bank account information and click Next.

-

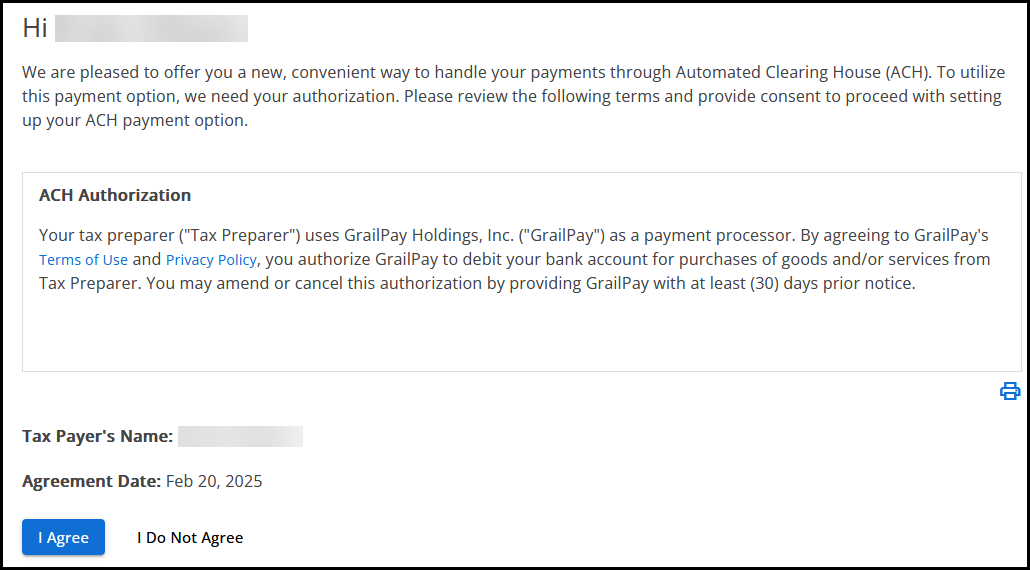

Review the ACH Authorization and click I Agree. If you click, I Do Not Agree, you are returned to the payment options page where you can select a different method.

-

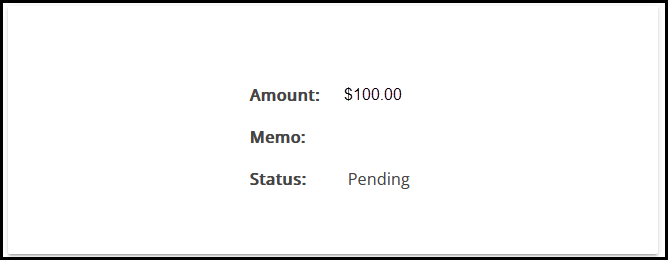

Once you agree, the payment will show as pending:

-

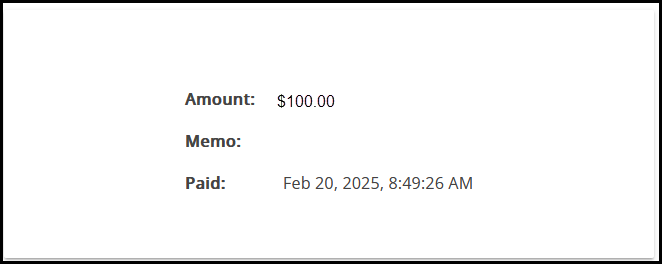

Once the payment is processed, it will show as paid with the date and timestamp.

Payment Cancelled

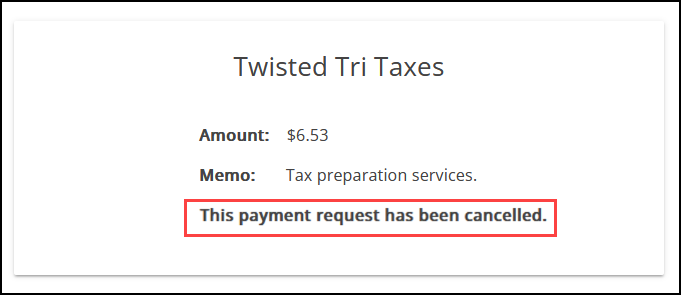

If the preparer cancels the invoice, you are notified that This payment request has been cancelled when attempting to pay the bill.

Partial Payments

Partial payments are not available at this time. Contact your preparer with questions.

Pay by Refund

If you have the option Pay with Federal Refund, you may be able to pay for your tax preparation fees by using your federal refund. If you are interested in this option, see Drake Pay - Drake Refund Pay instead.