EF - Forms Transmitted

Article #: 15784

Last Updated: December 05, 2024

When a return is completed, there can be a long list of forms and worksheets as a result of the numerous calculations, credits, schedules, previously filed extensions, future estimations, and various preparer to client communications. At this time, there is no expressed list detailing the contents of an e-file transmission, however, it is not to difficult to determine what will be included. Simply put, the transmission only contains what is required per IRS Schemas.

Tip For detailed information on Schemas, see the IRS Schemas and business rules.

Our development teams communicate with the IRS and State Departments consistently to stay up to date regarding the information required for processing returns. This allows Drake Software to make sure that the information you enter is presented in the professional manner you expect, while also ensuring that the transmission does not include any unnecessary information. When the return is ready to be e-filed, the IRS and/or State Department only receive what they need.

View/Print Mode and Sets

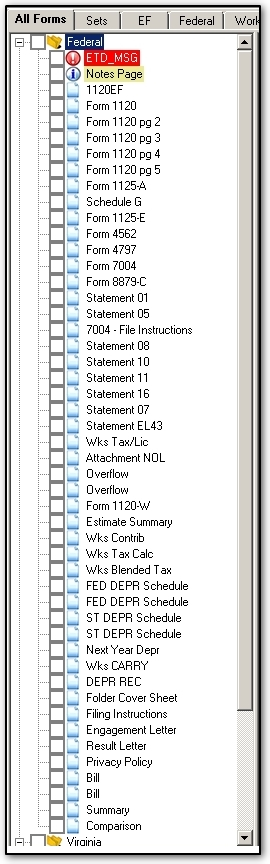

On the left, we can see the Federal portion of the All Forms list, as shown in Enhanced view. The list of information is quite extensive, however, not all of the forms will be transmitted with the return. In fact, much of the list is for record keeping and substantiation.

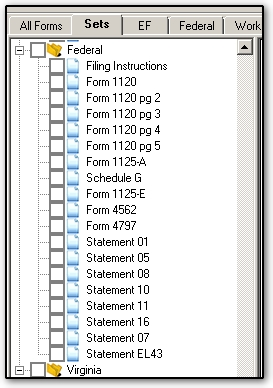

On the right locate the Federal Set. The Sets tab shows you an organized selection of forms. The Federal Set displays forms that the IRS would require if they were to be mailed. In this example, less than half of the forms from the Federal Forms list are present within the Federal Set. This is because the list provides all of the documentation for the calculations of the outcome, as well as communications to the taxpayer, and projections.

In the example above, a corporate return is shown. The forms that are required are:

-

Form 1120, substantiated by accompanying forms and schedules

-

1125-A - Cost of goods

-

4797 - Sales of business assets

-

4562 - Depreciation

-

1125-E and Schedule G - information regarding other individuals or entities involved.

-

There are also Statements which provide a required itemization of some items, such as Other Expense.

-

All of these items would be included in an e-filed transmission.

Forms

Generally speaking, if you are looking to see if a specific form is included, the answer may be within the header of the form or worksheet. Some forms and worksheets will specify if they should or should not be sent. If the IRS requires the form in a paper-file situation, generally that information will be transmitted with the return. For example:

-

Communications or letters (not shown)

-

Items, such as the result letter and bill, are produced exclusively for your client. There is no need to consider those as they are not included in the transmission.

-

-

Detail listings, and Worksheets

-

Some pages are marked Keep for your records. These forms, worksheets, or schedules are not required by the IRS or state DOR. Therefore, they are not included in any e-file transmission.

-

These forms are typically:

-

Supporting details for items reported elsewhere, such as the Depreciation Detail.

-

Items intended to provide useful information for preparing future tax returns, such as NOL Deductions, including current and prior year amounts available and used. This will assist with next year's return preparation.

-

-

-

Overflow Statements

-

Most commonly produced from detail worksheets, these statements provide an itemized list with a calculated total.

-

If the worksheet was not required, only the total flows to the line referenced and the statement is retained for record keeping purposes.

-

If the worksheet is required by IRS or the state DOR, the details will be included with the e-filed return.

-

-

Overflow Statements and Detail Worksheets

Generally, Overflow Statements are not included with the transmission. The total calculated on the statement flows to the form and field for which it was created. The resulting statement is for your records only (unless otherwise specified).

A common source of Overflow Statements are Detail Worksheets. Detail Worksheets are created by selecting a field in data entry and pressing Ctrl + W, double clicking on the field, or right-clicking in the field and selecting Add Worksheet. Some fields require a detail worksheet, and will open the worksheet window when you begin typing in the field. One such field is in an individual return on the C screen, Schedule C, Other Expenses, line.

-

Detail worksheets that get e-filed to the IRS will say IRS requires this field to have a worksheet. The Schedule C, Line 27A - Other Expenses worksheet is Part V, located at the bottom of page 2.

-

Detail worksheets that do not get e-filed will just say Detail Worksheet at the top of the screen.

-

This detail worksheet will produce a keep for your records Overflow Statement that will add the lines together and produce a total on Schedule C, line 1.