Drake Tax - Search EF Database, Common Acks, and Rejection Codes

Article #: 10783

Last Updated: November 03, 2025

After receiving acknowledgments, you must process them inside the software (EF > Process Acks) to incorporate them into the record of the returns to which they apply. When you process an acknowledgment, it becomes part of the EF record for that social security number and will be visible in your local EF database. To see the acknowledgment, go to EF > Search EF Database, enter the SSN in the box in the upper-left corner, and click Go. There is a separate set of EF data for each transmission. See Drake Tax - Return Status: Checking Acknowledgments for details.

Watch the video EF Database for a demonstration.

Acknowledgments for a return transmission are displayed in the middle of the Search EF database screen, and may include the following (detailed information below for some codes):

-

A ack - Federal or State accepted

-

a ack - Extension accepted (PCM only)

-

B ack - Bad transmission

-

D ack - Duplicate. This return is a duplicate of an accepted return - do not resend.

-

E ack - Return Imperfect return election

-

P ack - Pending / Processing

-

R ack - Rejected; click on reject number to see explanation.

-

S ack - Federal pending or rejected, return paper-filed with bank product info included

-

T ack - Test transmission (does not go to the IRS)

-

X ack - Bad transmission to Drake. Resend return, contact Drake Support if the problem persists.

Rejects are displayed under the Reject Information section on the right hand side. Click on the underlined code in the Reject Code column to display an explanation for that reject code. You can also review reject code explanations on the F4 - Reject Code Lookup tab.

In addition to the internal EF > Search EF database function, there is also an online database which may be accessed by clicking the F10 button while on the EF > Search EF Database screen. This will launch the online database on which you may run various reports and get other detailed information - see Drake Tax - Online Reports - Overview for details.

Ack Code Details

B Ack

The B ack means there is an error in the data of the actual file that was caught before we sent the file to the IRS. Often this means you have failed to install an update. Locate and correct the error and retransmit the return.

If you offer bank products, B acks may also mean that the add-on fee entered on your bank application does not match the one entered in Setup > Firm in the tax software.

B Ack 7206 Format Error is caused by the serial number in the transmission record not matching the one on file for that EFIN. It could result from entry of an incorrect serial number during installation or later editing.

E Ack

The E ack indicates that the Imperfect Return Indicator was selected for this return and it has been processed and accepted.

P Ack

A P ACK indicates that you have transmitted and Drake has received a live return, which will be forwarded to the IRS or state DOR.

T Ack

A T ACK indicates you have transmitted and Drake has received a test return.

S Ack

If a return is pending or rejected, and you are unable to get the return fixed, re-transmitted, and accepted electronically, you may choose to paper-file. If the return is mailed in with bank product direct deposit information contained on the return, it will receive an S ack when the IRS processes the paper-filed return.

The return has to have been e-filed and received either a pending or rejected ack before a bank product can be processed from a paper-filed return.

The S Ack allows you to print ERC/RT type checks on those refunds in the office and still receive a direct deposit for the preparer fees as well.

An S ack can also appear briefly when a bank ack posts before the IRS ack - the S will convert to A when the IRS ack posts.

X Ack

The X ack means the file is a bad transmission. The file will need to be re-transmitted. If this problem persists, contact Drake Support.

Reject Code Lookup

To look up a reject code, go to EF > Search EF Database. Select the F4 - Reject Code Lookup tab. Enter the reject in the Reject Code box, then hit the Go button next to it and the return type selections above it.

This function is available even if you do not have any returns with this reject currently in your database.

Note If a return is rejected, you must correct it during the perfection period for it to be considered timely filed. See Drake Tax - Top Federal Rejects for a list of common rejects and how to resolve them.

The perfection period is not an extension. If you do not make a timely filing, there is no perfection period. DRKPARSE and Drake B-ack errors do not qualify for the perfection period.

IRS Reject Code

Select 1040 and then select FED from the Category drop list. Enter the reject code in the Reject Code box and click Go. The IRS explanation of the code is displayed in the window below.

State Reject Code

Select 1040, then select the state from the Category drop list. Enter the reject code in the Reject Code box and click Go. The state explanation of the code is displayed in the window below.

Bank Codes

Loan Status Codes - select this to view loan status codes and descriptions (there is no Category selection). See Drake Tax - Bank Status Codes for details.

e-File Status Feature

![]()

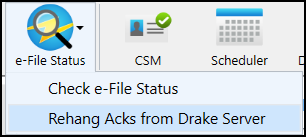

The e-File Status feature is an expansion upon the existing e-File Database. e-File Status helps consolidate e-file tasks—including EF > Transmit/Receive > Acks Only and EF > Process Acks—while allowing you to check your firm’s up-to-date e-file records using the EF Database you are already familiar with (EF > Search EF Database). The e-File Status feature can be accessed only by those with sufficient Drake Tax security permissions.

Upon clicking e-File Status, you are given the option to check for and process new acknowledgments from recently e-filed returns. If you have new acknowledgments from Drake Software that need to be processed, a red indicator appears on the e-File Status icon. All information received through e-File Status is automatically added to the EF Database, accessible from both Drake Tax and the Drake Software Support website > Reports > E-file Status Lookup).

Rehang Acks from Drake Server

Note This feature expansion was released November 1, 2024.

You can now select the option Rehang Acks from Drake Server when using the e-File Status feature. This allows you to rehang your own acknowledgments to ensure that the acks in Drake Tax are the same as on the Drake server. The process is as follows:

-

Click on the e-File Status icon on the Home screen of Drake Tax.

-

Select Rehang Acks from Drake Server.

-

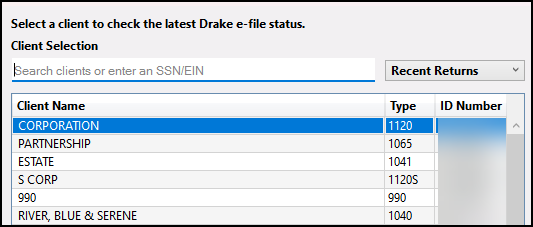

On the Client Selection window, select the individual or business taxpayer for whom acks need to be reviewed.

-

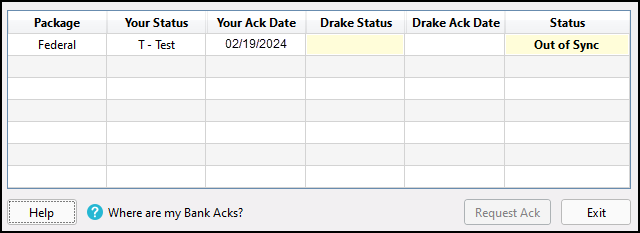

A grid shows e-filed returns for the selected taxpayer. Compare the acknowledgment status on your local installation (Your Status) with the status that shows on the Drake server (Drake Status). If you see "Out of Sync" under the Status column, click Request Ack to synchronize the information between the local and Drake database.

-

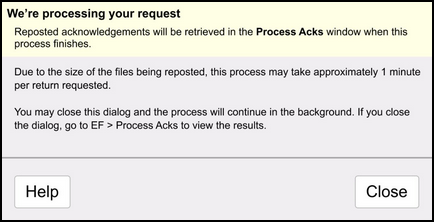

A message displays to let you know that the request is being processed.

-

You can wait for the process to be completed, or Close the dialog box and work on something else while the acks are synced.

-

If you choose to wait, the Process Acks window will open automatically after the request is complete. Review and print acks as needed.

-

If you exit the processing window by clicking Close above, you will need to manually go to EF > Process Acks to review results.

-

Important Bank Acks are not rehung during this process. If you need assistance with bank acks, or an EF Rebuild due to a computer crash, contact Drake Support at (828) 524-8020 for assistance.

Related Links

Drake Tax - Top Federal Rejects