e-Filed Returns Locked After Acceptance

Article #: 12280

Last Updated: November 03, 2025

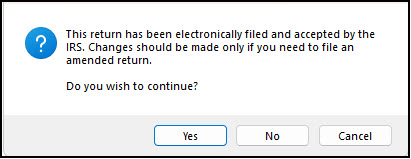

If you have selected the option Lock client data file after EF acceptance at Setup > Options > EF, when you attempt to open a return that has been e-filed and accepted, you see a warning message with Yes, No, and Cancel options:

If you have sufficient permissions, click Yes to proceed, the return opens normally. In this circumstance, the displayed message serves only as a warning.

Caution The current return may vary from the originally e-filed return if tax law changes have been implemented by software updates. To review a return as it was e-filed, go to View/Print mode > Documents > Archive Manager and restore the "Selected for EF" archive. Alternatively, go to Drake Documents and review the PDF copy of the return (if you saved a PDF at the time of filing (recommended)).

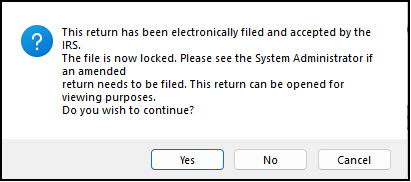

Limited Security Rights

A preparer who has limited security rights will see a slightly different message when attempting to open an accepted return. If they click to open the return, they will see gray data entries fields that are "read only."

If the preparer should have permission to edit locked client files, verify their settings under Setup > Preparers and Users. If using Custom Security, enable the option Unlock Client Files under Tools > File Maintenance. A preparer with security set to Allow all options will also have the ability to make changes to locked files. See Drake Tax - User or Preparer Security Rights for more information about security setup.

Unlock Client Files

Locked accepted returns can also be opened by going to Tools > File Maintenance > Unlock Client Files. This does not eliminate the warning message or change the locked status of a return. It simply opens the return to the warning message. A preparer with inadequate security will not have access to that menu.