Drake Zero or Web1040 - e-Filing

Article #: 18015

Last Updated: October 14, 2025

Important Drake Zero and Web1040 will be sunset in 2025. Drake Tax Online is our new web-based software. See Drake Tax Online - Overview for details.

To e-file a return using Drake Zero or Web1040:

-

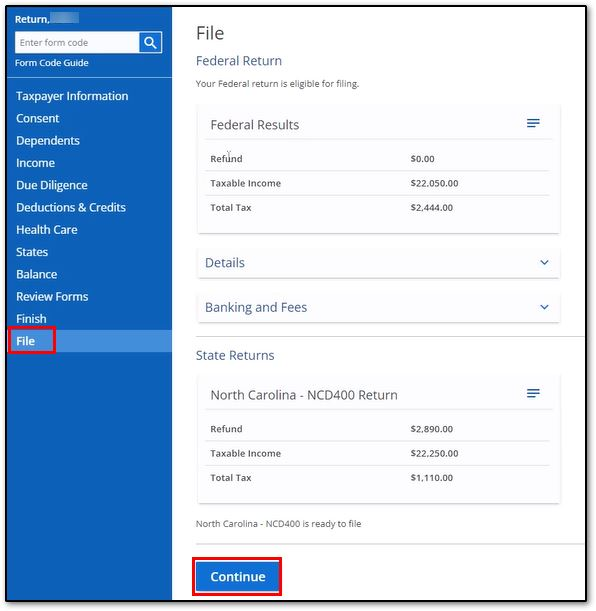

Click on the File tab.

-

Verify the information, and click Continue.

-

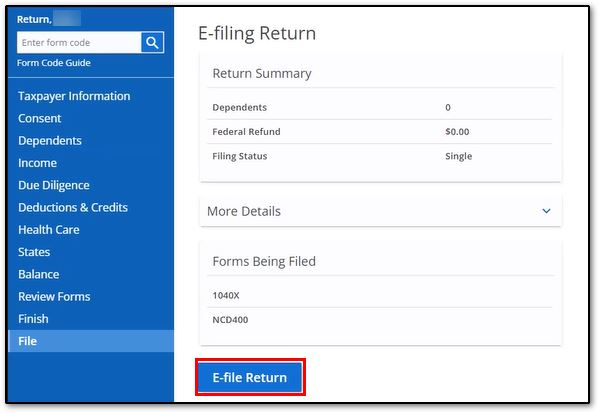

Review the details for accuracy, then click E-file Return:

-

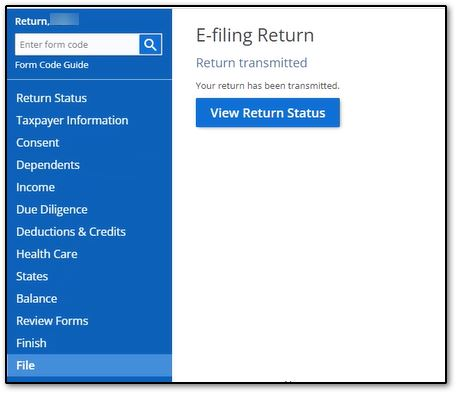

The return is transmitted:

-

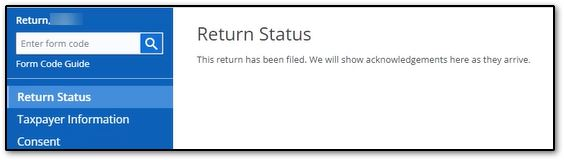

To check the status, click on the Return Status tab.

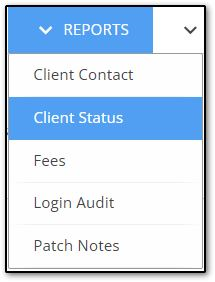

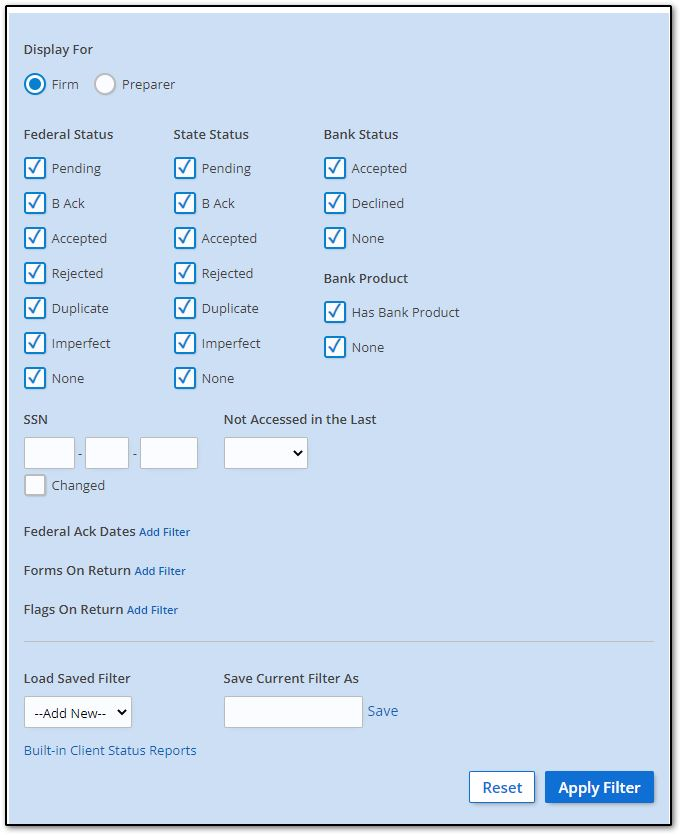

You can also run a report by exiting the return and clicking on Reports > Client Status. You can run a report for all returns, or enter a SSN to search for detailed information for a single taxpayer.

Note Filters may vary depending on office setup.

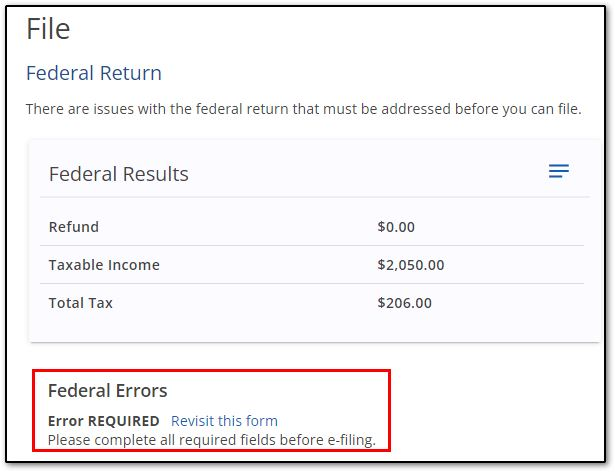

EF Messages

The example above shows a federal and NC state return that are both ready for e-filing with no error messages. If any errors are shown, they must be corrected before e-filing is available. Click the blue link to return to the relevant entry form: