Drake Accounting - Updating Prior Year Client Chart of Accounts

Article #: 15120

Last Updated: December 05, 2024

When you first open a client’s Chart of Accounts (COA) in Drake Accounting 2026, the software will either update the COA automatically from Drake Accounting or it will prompt you to set up a new COA. Make sure the COA is set up by entering all beginning account balances before beginning bookkeeping in Drake Accounting 2026.

Note 2026 refers to the current year, 2025refers to the prior year.

There are three situations that can occur when updating a client's COA into Drake Accounting 2026:

-

If the Drake Accounting COA has been closed out for the year:

-

A full COA update brings forward both the account structure and balances from the prior year.

-

Drake Accounting will automatically do a full Chart of Accounts update when the Client has been brought forward from the previous year.

-

-

If the Drake Accounting COA is corrupt, but has been closed out:

-

The account structure is brought forward with zero balance on each account.

-

You can enter beginning account balances until you make your first journal entry.

-

Once you enter an account balance, that account balance can be modified only by a journal entry.

-

Important Do not make any journal entries until all beginning account balances have been entered. Once you make a journal entry, you cannot enter beginning balances for any of the accounts.

-

If the Drake Accounting COA cannot be closed out:

-

Only the COA account structure can be updated.

-

Once the prior year bookkeeping has been closed out in the prior year, go to Accounting > Update Prior Year in Drake Accounting 2026 to bring forward those balances.

-

Important After going to Accounting > Update Prior Year and going through the process, open the client and go to Client > Edit > Business Information tab to verify the Start of Year date is correct.

1. Year End Close has Already Been Done in Drake Accounting 2025

If you have done a Year End Close in Drake Accounting 2025 and are updating the client into Drake Accounting 2026, you do not need to go to Accounting > Update Prior Year in Drake Accounting 2026because the COA will automatically come over.

-

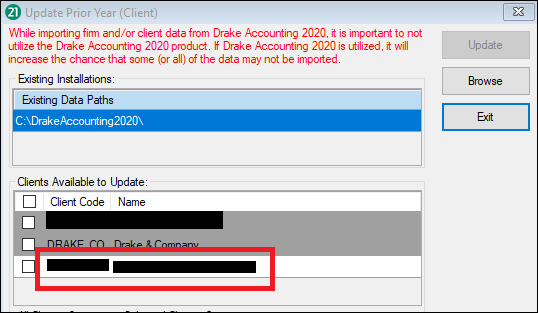

If you do this and then go to Accounting > Update Prior Year in Drake Accounting 2026, the clients that are available to be updated will be highlighted in a dark gray, as shown below, which means the COA has already been updated.

-

Updating it again will cause the amounts in the COA to be what they were in Drake Accounting® 2025 when doing the Year End Close.

-

It will bring over the posted transactions from the 2025 software.

-

The COA screen will be overwritten, but the update would not replace any of the transactions.

-

-

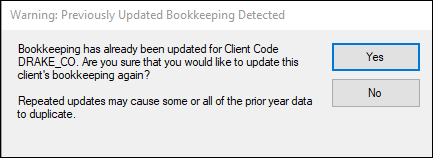

The following message will appear:

-

Choose Yes if you are certain that you want to re-update the bookkeeping.

2 or 3. Year End Close has NOT Already Been Done (or cannot be done) in Drake Accounting 2025

If you have not done a Year End Close in Drake Accounting 2025:

-

Update the Client from the 2025 software into Drake Accounting 2026 (Client > Update Prior Year).

-

After you are finished with all the 2025 bookkeeping in the 2025 software, complete a Year End Close by going to Accounting > Year End Close.

-

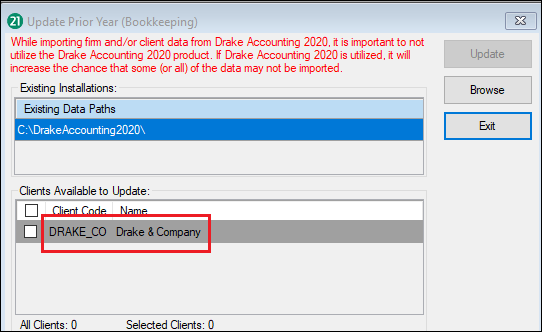

Once completed, in Drake Accounting 2026, go to Accounting > Update Prior Year.

-

Select the appropriate data path.

-

If the needed data path is not listed, click Browse.

-

-

Select the DrakeAccounting2025 folder.

-

Do NOT go into the folder. Selecting something from within the folder will result in a message: Installation path is invalid. Unable to find DrakeAccounting2025.exe in the selected path. Please select a valid installation path.

-

-

Once the correct path is selected, if a client's bookkeeping is able to be updated, it will be listed in white, to indicate that their COA has not been brought over yet.