Drake Accounting - 94x PIN Applications - Reporting Agent PIN

Article #: 15677

Last Updated: July 22, 2025

A reporting agent is an accounting service, franchiser, bank, or person who complies with IRS Revenue Procedures 96-17 and is authorized to electronically sign and file a Form 940/941 on behalf of a taxpayer. This authorization is begun with the submission of Form 8655, either by the client or the reporting agent. There must be a Form 8655 signed by the client for each of the reporting agent's clients. Reporting agents sign all the electronic returns they file with a single 5-digit PIN signature that is issued by the IRS after they have submitted the application (see step 5 below).

Caution The reporting agent must have an EFIN before submitting Form 8655. If you already have an EFIN, you still must update the information to be able to e-file 94x series tax returns. Log on to your IRS e-Services account to update this information.

If a Reporting Agent gives tax advice, they must also have a PTIN (Preparer Tax Identification Number). If they do not offer tax advice, a PTIN is not required. Refer to the IRS website for more information about PTIN requirements.

If you apply to be a Reporting Agent, you can complete and sign a Form 8655, include your company on the Reporting Agent’s List, and use your 5-digit Reporting Agent’s PIN to e-file 94x series tax returns for your own company.

Form 8655

-

Download Form 8655 from the IRS website (http://www.irs.gov/pub/irs-pdf/f8655.pdf) or from the main menu of Drake Accounting, go to On the Fly > Federal Forms > Form Type: Form 94x > Form: 8655. You can also print a blank form from Tools > Print Blank Forms, select the Federal 94x series, and double-click Form 8655. Click the print icon. Print and fill out one Form 8655 for each client for whom the reporting agent will file.

-

Have each client sign a Form 8655.

-

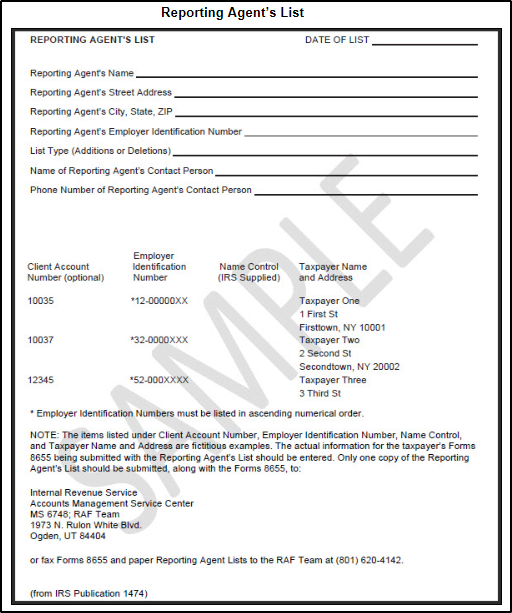

Create a Reporting Agent’s List. This is required to be attached to Form 8655 and is a list of clients included in a batch being submitted for e-filing approval. See Publication 1474 for an example.

-

Fax (IRS preferred) or mail the signed Forms 8655 and the Reporting Agent’s List to the IRS.

IRS Fax: (855) 214-7523

Internal Revenue Service

Accounts Management Service Center

MS 6748 RAF Team

1973 North Rulon White Blvd.

Ogden, UT 84404 -

In approximately two weeks, reporting agents receive a mailed notification of acceptance from the IRS and, in a separate mailing, a five-digit signature PIN.

Reporting Agent Setup

Client

To complete the 94x e-filing setup for the client:

-

Make the appropriate client the active client

-

Go to Client > Edit > e-File Options

-

Select the e-File 94x check box

-

Select the Transmit as Reporting Agent check box

Caution Do not select Transmit as Reporting Agent until you have received a letter from the IRS listing the client as approved for the 94x e-filing program. The client’s 94x tax return will be rejected if you e-file their return as a Reporting Agent before they are approved by the IRS.

-

Enter the client’s Name Control for e-File. The IRS should fax the Reporting Agent’s List back to you with the client’s Name Control for e-File written beside each client listed.

Note Do not make an entry in the Taxpayer 5 Digit PIN for e-File, Ten Digit Signature PIN, and Signature Name fields when Transmit as Reporting Agent is selected.

-

Click Save.

Firm

To complete the 94x e-filing setup for the firm:

-

Go to Firm > Firm Information Setup.

Caution In order for the firm to e-file any of their clients’ 94x tax returns, the e-File Setup section of the Firm > Firm Information Setup screen must also be completed.

-

Make sure the e-File 94x check box is selected.

-

Enter the five-digit PIN you received from the IRS into the Reporting Agent PIN text box. You only need to enter this once.

-

Enter the firm’s Business Name Control (if not previously entered). If you are unsure what to put here, have an officer of the firm contact the IRS EIN verification line at 800-829-4933. An incorrect Name Control will cause ALL of your e-filed 94x returns to reject. You only need to enter this once.

-

Click Save and Exit.