Drake Accounting - ERO e-Filing 94x - Completing Form 8879-EMP

Article #: 15742

Last Updated: December 05, 2024

If you e-file a Form 94x as an ERO, you are required to prepare and keep Form 8879-EMP for four years. Form 8879-EMP is produced when you print the Form 94x. (If you e-file as a reporting agent, Form 8879-EMP is not required or produced.)

You are e-filing as an ERO if Transmit as ERO is selected on the e-File Options tab within the Client > Edit or Add window.

To comply with IRS instructions, Form 8879-EMP must be completed and signed before the electronic return is transmitted (or released for transmission).

Follow these steps. Form 941 is used below as an example.

-

Prepare the 941 and click Save on the data entry screen.

-

Print the document. The last two pages of the PDF displayed on your screen are Form 8879-EMP and the form instructions.

-

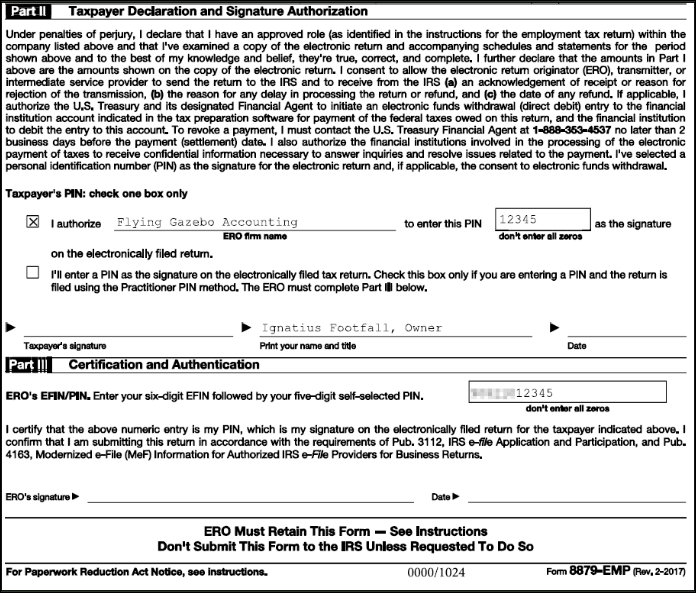

In Parts II and III of the printed Form 8879-EMP (shown below)

-

The taxpayer should:

-

Check the appropriate box in Part II.

-

Sign on the Taxpayer's signature line. The printed name, title, and date have been completed by the software.

-

If requested, photocopy the completed form for the taxpayer’s records. Follow the Form 8879-EMP Instructions regarding retention:

"Don't send Form 8879-EMP to the IRS unless requested to do so. Retain the completed Form 8879-EMP for 4 years from the return due date or IRS received date, whichever is later."