Drake Accounting - 941-X - Amended Quarterly Return

Article #: 16167

Last Updated: October 14, 2025

-

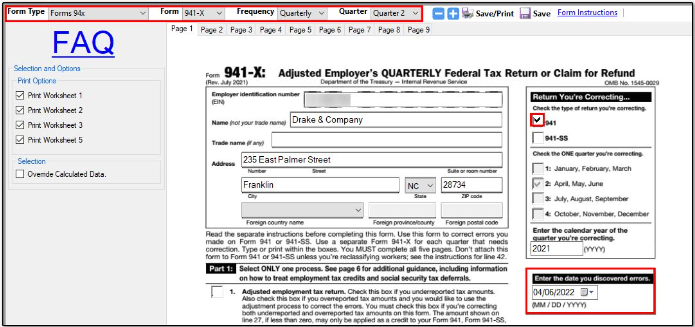

Form Type: Forms 94X

-

Form: 941-X

-

Frequency: Quarterly

-

Quarter: Choose the applicable quarter that needs to be corrected.

In the Return You Are Correcting area at the top right of the 941-X form, you must indicate which form you are amending. The quarter is checked by the selection detailed above. Then complete any other necessary fields on the Additional tabs.

Beginning in 2024, Form 941-X can be e-filed.Form 941-X can only be e-filed a single time. If you attempt to e-file a second time, it will be rejected. You would need to paper-file any further corrections.

Note There is a known issue with Worksheet 2, Line 2j not calculating as expected under certain circumstances when making corrections to the 2021 Q1 Form 941. For a workaround, enter an amount on Worksheet 2, Line 2b and then set it to its original value. This will update the applicable lines on that page.