Drake Accounting - Qualified Overtime Compensation - "No Tax on Overtime" (New Tax Bill)

Article #: 20064

Last Updated: February 11, 2026

Notice 2025-69 provides guidance for taxpayers eligible for the federal income tax deduction for qualified overtime compensation under the “no tax on overtime” provision of the new tax bill.

For tax year 2025, employers are not required to separately report or account for qualified overtime compensation on Form W-2; however, employers may choose to include this information on:

-

Form W-2, Box 14, or

-

A separate accompanying statement.

You would need to manually calculate and enter the amount on Forms W-2 created in DAS 2025. Alternatively, you can attach a statement that you create outside DAS. You can use the Total Overtime report to see the overtime hours and pay for each employee (go to Employees > Reports > Total Overtime Report). Please note that the total overtime may not be the same as qualified overtime.

2026

Setup

-

To set up the qualified overtime, go to Employees > Options.

-

Set up the default overtime factors for calculating overtime by entering the factor number in the Overtime Factor field. Then select Apply To All Employees to apply these factors to each employee.

-

Make the appropriate selection under Qualified Overtime Calculation Options.

-

Select FLSA Compliant if the overtime is fully FLSA compliant at 1.5 factor. This only affects the end of year calculation, not the overtime calculation in payroll.

Note FLSA Compliant – Overtime entered in payroll matches and does not exceed FLSA is selected by default.

-

Select Manual Entry to manually enter the qualified overtime

-

Select FLSA Plus if the overtime factor exceeds 1.5 or if your state, such as California, has extra requirements like calculating overtime daily instead of weekly or biweekly.

After all required information has been entered, select Save.

Employee-Level Setup

-

Navigate to Employee > Employee Setup > Payroll Wages tab and configure each employee individually.

-

Select an employee. These options must be set individually for each employee.

-

Enter the default rate for the employee. If the employee’s overtime factor differs from the default in Employees > Options, update it here.

-

Once done with the Employee setup, click Save.

Entering Overtime in Payroll

-

Go to Employees > Payroll > Live or ATF.

-

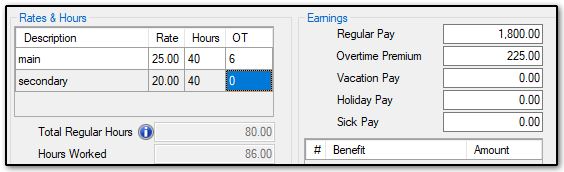

Enter overtime hours in the OT field towards the left of the screen (do not include overtime hours in the regular Hours field). The required overtime amount is calculated and displayed in the Earnings grid. The overtime rate and the pay rate to which it applies are what you previously set up for the employee.

-

Once all fields are complete, click Save to apply your changes.

Overtime Report

Overtime hours and pay will be displayed in the Hours Report (Employees > Reports > Total Overtime Report).

Additional Information

Related Links

Drake Accounting - Qualified Tips - "No Tax on Tips" (New Tax Bill)

Note This new tax bill, was signed into law on July 4, 2025. The One Big Beautiful Bill Act (OBBB or OB3) is now also being referred to by lawmakers as the Working Families Tax Cut Act. You may see one or both names used, but they refer to the same set of tax changes.