Drake Accounting - No Tax on Tips

Article #: 20065

Last Updated: December 16, 2025

The new “no tax on tips” rule allows eligible tipped workers to deduct up to $25,000 of qualified tips from federal taxable income for tax year 2025 (filing in 2026) and subsequent years through 2028.

Creating tipped employees in DAS

-

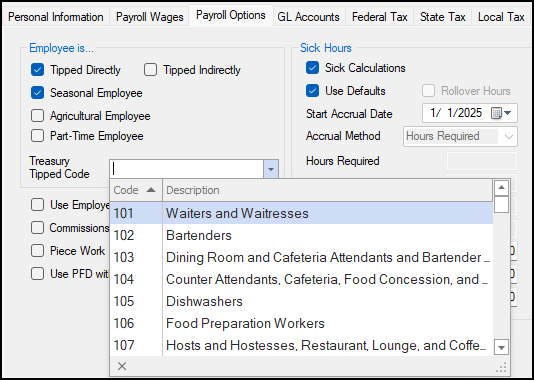

Go to Payroll Options tab under Employees > Employee Setup. An employee can be tipped both directly and indirectly, if applicable.

-

Direct tips are tips the employee receives directly from the customer, without the employer controlling who gets them. An example is cash handed directly to a server.

-

Indirect tips are tips received from a tip pool or indirectly because of the customer’s tip but not given directly to the employee by the customer. An example is when a busser gets a share of the server’s tips through tip pooling.

-

-

Select the tipped code from the Treasury Tip Code drop list. In some situations, an employee may work in a different position at another location. After selecting the alternate location, choose the appropriate treasury tipped code for that position. See Drake Accounting - Multi-Location Employee Payroll for more information on how to enter multi-locations for employees.

-

Once you have the employee set up as a tipped employee with the tip code selected, click Save.

-

Then go to Employees > Payroll > Live or Employees > Payroll > ATF. Select the employee and enter the applicable direct or indirect tips.

-

At the end of the year, the tipped code will show on Form W-2.