Drake Tax - Short Year Return

Article #: 10719

Last Updated: October 14, 2025

You cannot generate a short-year individual return in Drake Tax. Only a calendar-year individual return can be generated. There is no option to change this.

Business Returns (1120, 1120-S, 1065, 1041)

Drake Software produces short-year business returns that can be e-filed in the current year and two preceding years. A short-year business return older than two preceding years can be produced in prior versions of Drake Tax, but it must be paper-filed.

Important The return must reflect the laws and calculations applicable to the short-year period even though the software being used is the prior-year software. The program may not correctly calculate depreciation, gains, or losses for a short-year return. Depreciation for a short-year should be entered on screens 4562, 6, 7, and 8, as applicable. See Return Note 321 for details.

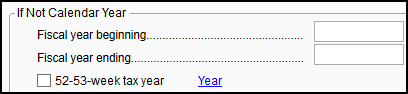

To generate a short-year return, enter the appropriate dates in the fiscal year fields on screen 1.

- If this is an initial or final return, also check the box Initial Return or Final Return on screen 1.

-

If this is not an initial or final return, you will need to make an short year election on the YEAR screen.

Note 1041 returns do not support short-year elections or filing other than in the initial or final year.

If appropriate selections are not made, EF Messages will generate:

-

0081 or 0084 for an 1120

-

0720 or 0727 for an 1120-S

-

0101 for a 1041

-

1023 for a 1065

Caution Filing a final short-year return in the same tax year as a previously accepted return will require the short-year return to be paper-filed.

Drake Tax - Duplicate Business Return Rejection - Not Amended or Superseded

Short Year Elections

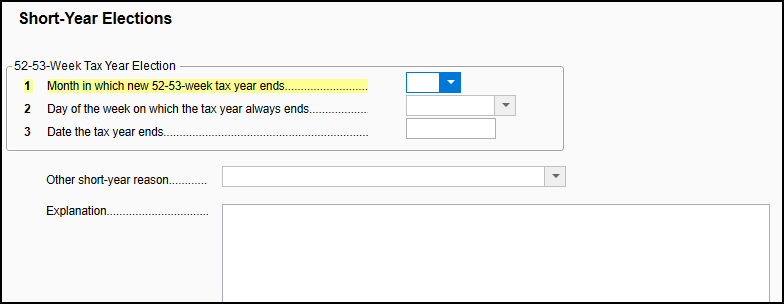

In 1120, 1120-S, and 1065 returns, use the YEAR screen to elect a 52-53 week year or to select that it is a short-year for another reason.

First year

To elect a 52-53 week year in the company’s first year, complete the first part of the YEAR screen. The required statement is produced.

Final Year

If the short-year reason is "final year," take the following steps:

-

On screen 1, enter the dates of the short year (20YY) in the Fiscal year begins and Fiscal Year End fields.

-

Mark the Final return check box.

-

Open the YEAR screen, and from the Other short year reasons drop list, select General Explanation.

-

In the Explanation text box, type Current Year Software Not Available - Final Year.

Change in Tax Year

If the reason is a change in tax year, take the following steps:

-

On screen 1, enter the dates of the short year (20YY) in the Fiscal year begins and Fiscal year ends fields.

-

Open the YEAR screen, and from the Other short year reasons drop list, select Filed under Revenue Procedure 2006-45 or 2006-46.

-

No explanation is needed in the "Explanation" text box, but you may need to consider if Form 1128 should also be filed.

-

If Form 1128 is to be included, it must be completed and signed outside the program and attached as a PDF with Form 1128 for Short Period Return as the Description on screen PDF.

Other Reason

To elect a short-year return for some other reason, that is not on the Other short-year reason drop list, select General Explanation as the reason, and in the Explanation field, type an explanation. Statement 1935 is generated in View/Print mode.

Related Links

See Publication 4163, for more information. Also See "Period Covered" in the form instructions for short-year returns: