Drake Tax - Prior-Year Balance Due and ES Vouchers

Article #: 14069

Last Updated: December 05, 2024

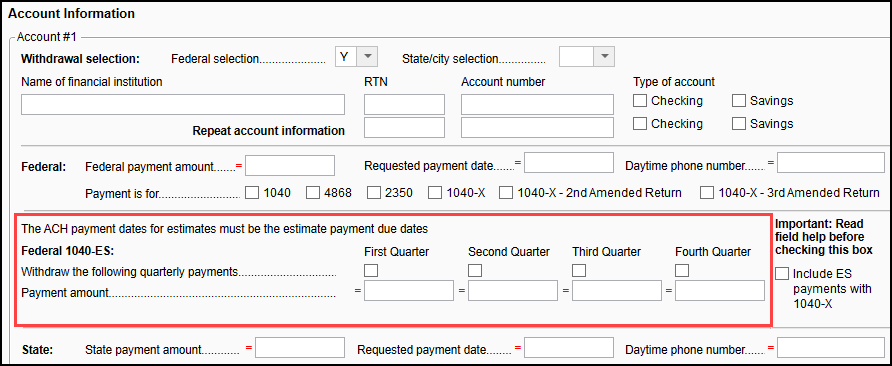

Federal Balance Due:

You can pay a prior-year balance due electronically through the PMT screen within the prior year program. The payment would need to be setup and transmitted along with the original filing of the tax return.

Estimated Tax Payments:

Direct debit of ES payments cannot be made in prior year software. Estimated Tax Payments have to be made before the due date of the selected voucher(s). If you send the return after the due date of the ES Voucher you can unselect the past due voucher(s) check box on the PMT screen.

Caution Reject 'FPYMT-086' may result from an ES voucher being transmitted after the printed due date of the selected voucher(s).

For information on setting up an electronic payment within Drake see Drake Tax - Federal and State Payments - Electronic Funds Withdrawal Setup .