Drake Tax - Data Entry Basics

Article #: 13109

Last Updated: November 03, 2025

Note This article comprises former articles 13320, 14177, 14901, 13124, and 13109. It is herein referred to as KB 13109.

The following sections detail the basics of Drake Tax data entry, including what field colors mean, how to use the special F or ST boxes, and how to use override or adjustment fields.

A field in data entry shaded (or highlighted) in red generally indicates a detail worksheet has been created for that line item. To examine the items in that detail worksheet, double click on the field or press CTRL + W to open the worksheet.

Each detail worksheet requires a title and a description with a corresponding amount for each line item. When a detail worksheet is created in the federal return, it appears in View/Print mode on a page labeled OVERFLOW. When a detail worksheet is created in a state return, it will appear in View/Print mode on a page labeled XXOVFLOW, where “XX” represents the two-letter state abbreviation.

A field in data entry shaded (or highlighted) in bright green generally indicates that the field has been flagged for review. This is also referred to as an unverified field. See Drake Tax - Flagging and Clearing Flagged Fields for more information on setting up and clearing flagged fields.

Fields may appear in bright green if brought forward from the prior year or if flagged by a conversion program as an item requiring verification.

Red and bright green are system defaults on the Color Selection dialog box (Setup > Colors) shown below. If you customize these selections, the fields may not be highlighted in red or green, but in the color of your choosing.

MFC or “Multi-form code”

The multi-form code box is used to direct income or deductions from one screen or form to another.

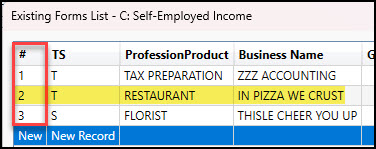

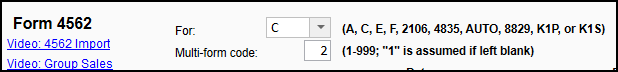

For example, a taxpayer is depreciating some assets using Form 4562. The assets being entered belong to the taxpayer's business. In this return, the taxpayer and spouse have 3 separate businesses reported on Schedule C. Which multi-form code to use is determined by the order in which the Schedule C forms were entered. This is displayed in the Existing Forms List that displays when you go to open a screen with multiple pages.

As you can see, the second Schedule C is for the restaurant. Since the restaurant is the second form on the list, use MFC 2 on the 4562 screen.

Schedule E Properties

When you are using the multi-form code with rental properties on Schedule E, the multiform code refers to the property, not the Schedule E. Each property (in other words, each screen) has a separate multi-form code. The MFC number used on the asset screen (for instance, on screen 4562) for a Schedule E should refer to the property (to the screen the property is listed on), not the instance of the Schedule E. (Up to three properties are printed on a Schedule E.)

Note When there are multiple depreciation detail screens and multiple Schedule E properties, the software will generate a Form 4562 for each property.

Override or Adjustment Fields

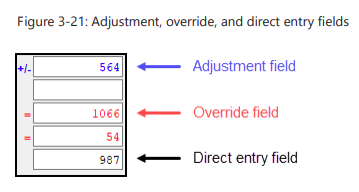

Fields that allow overrides are preceded by a red equal sign (=) and display red text. Data entered in these fields replaces, or overrides, program calculations.

Fields that allow adjustments are preceded by a blue plus/minus sign (+/-) and display blue text by default. Data in these fields adjust program calculations by the amount entered. A positive number increases the calculated amount; a negative number decreases it.

"F" Field

The field labeled “F” that appears on some data entry screens can be used to exclude items from the federal return. Entering a "0" in this box will prevent data entered on these screens from appearing on the federal return. This is most commonly used when information needs to flow to state returns, but not to the federal.

For example, 1040 returns that report multi-state Schedules K-1 often require that a separate K-1 screen be created for each state. The information from each K-1 screen may not need to be reported on the federal return - using the “F” box will exclude the information from flowing to the 1040, while still allowing data to flow to the state returns (see Drake Tax - 1040: Multi-State K-1 Entry for more information on this particular example).

ST Field

The ST drop down is used to indicate what state is involved. When you make a selection on this dropdown, the information will be carried to that state return. In some cases, this can generate a state return. You can choose 0 to suppress that screen from being used by any state returns.

Note Some states pull information directly from the federal return, so this may not be applicable in all cases.

State Overrides

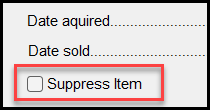

If information from the federal return is being carried to the state return, you may need to go into the state data entry screen for that form and choose to suppress the item from being carried to that state. The checkbox wording may vary depending on the form or state involved.

Important This function may not be available for all state forms or screens.

See the following for more information on state returns:

Invalid Character

Limited punctuation is allowed by the Modernized e-File (MeF) system. Only single spaces, hyphens ( - ), and slashes ( / ) are allowed in most fields.

A corporate return allows letters and numbers in the corporate name. The following special characters are also permitted:

-

Pound sign ( # )

-

Ampersand ( & )

-

Apostrophe ( ‘ )

-

Parentheses ( )

-

Hyphen ( - )

-

Blank space

Common punctuation errors include a period ( . ) after street name or P.O. Box as well as a comma ( , ) in the firm’s name. To correct these, calculate the return and double click on the error message (Calculation Results window) to see where the invalid character is located. It may be necessary to retype that field.

In View/Print mode, the MESSAGES page also tells you where the invalid character exists.

ZIP Codes

After you enter the zip code and press Enter, the software fills in the city, state, and resident state. You will need to select the resident city and school district (if applicable).

Note Some ZIP Codes differ within the same city or county, or may be used by multiple counties or locations. When you type in a ZIP Code, Drake Tax uses a ZIP Code database to auto-fill the City, State, and County. This feature uses the first option that is found, whether city or county, obtained from US resources. Generally, this option contains the majority of locations referenced by the code. If the taxpayer's address is actually in another county, you can change this by letting the information auto-fill and then editing the City or County field.

Related Links

Drake Tax - Creating a New Return