Drake Tax - 1040: Part-Year (Multi-State) Resident

Article #: 12885

Last Updated: December 05, 2024

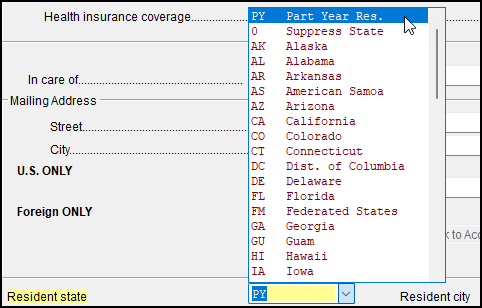

For a part-year resident, on federal screen 1, select PY Part Year Res. from the Resident State drop list.

After making the federal selection, navigate to the state specific data entry screens to complete any required part year residency information, such as dates of residency, for each state in which the taxpayer lived.

Important Even if all state part year forms are filled out, the states do not begin to produce part year information until federal screen 1 is marked PY.

An individual return marked PY (for Part Year Resident, in the Resident state field on screen 1) requires the ST drop list on some federal screens to be entered - select a state in the ST field if you intend to e-file. These fields are color coded with the default color being light blue.

Once data entry begins on these screens, if you have not made a state ST selection, before you exit the screen, one or more of the following will happen:

-

you may be prompted to make a selection,

-

an unnumbered EF message is produced in view mode that prevents e-filing,

-

the screen link on the data entry menu is color coded light blue for identification.

This change from prior years reduces data entry issues in part-year resident state returns by providing consistent data flow from federal screens to the state returns. The ST field remains optional in returns for full year state residents.