Drake Tax - Business Returns States Tab

Article #: 13791

Last Updated: December 05, 2024

Several states require the source documents for e-filed returns that include:

-

miscellaneous income on Form 1099-MISC,

-

unemployment compensation on Form 1099-G,

-

or gambling income on Form W-2G.

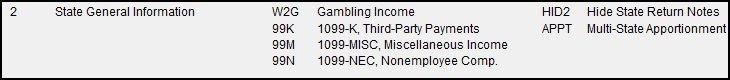

This income can be entered in Drake on screens listed at the bottom of the States tab:

-

Screens W2G and 99M on 1065, 1120, and 1120S returns.

-

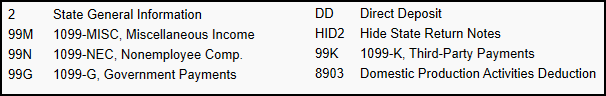

Screens 99M or 99G on 1041 returns.

On the 99M, 99G and W2G screens, only state tax withheld on the screen flows to the state form. No data entered on these screens flows to the federal form.