Drake Tax - 1040 - State Taxes on Wks CARRY

Article #: 14073

Last Updated: December 05, 2024

Review state worksheet STWK_A5 where ST is the state to which taxes were paid. For example, if the taxes were paid to North Carolina, and will be deductible on the following year's return, you would review NCWK_A5 in View/Print mode.

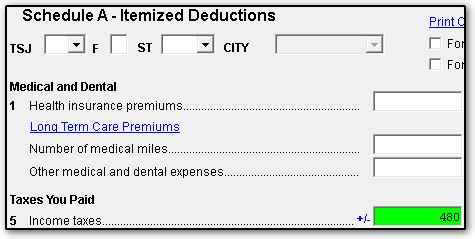

This amount will update to next year's return, Schedule A, line 5 and be flagged (in green) for review. You should verify this amount for accuracy in the updated return. It is the preparer's responsibility to determine whether the client can deduct the full amount that carries to Schedule A, line 5 from the prior year.

For more information about deducting state or local taxes, see the Schedule A instructions.

Multi-State Returns

If this is a multi-state return, you must review the WK_A5 for each state in order to reconcile the total amount showing on Wks CARRY.