Drake Tax - 4852: Substitute W-2 or 1099-R

Article #: 11094

Last Updated: December 05, 2024

To complete a substitute for forms W-2 or 1099R:

-

Complete the W2 or 1099 screen in data entry.

-

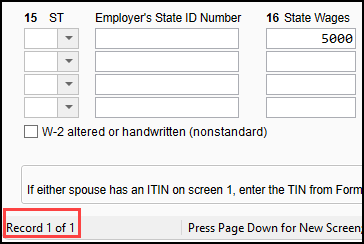

On the W2 or 1099 screen, locate the record number for the screen. It's located on left side of the bar at the very bottom of the screen. In this W-2 example, the screen is record 1 of 1:

-

Open the 4852 screen (Other Forms tab). Enter the record number of the W-2 or 1099 to which the 4852 applies in the appropriate field that asks To which Form W-2 does this information apply? or To which Form 1099 does this information apply? This entry links the 4852 to the W2 or 1099 screen with the information to be substituted.

-

Complete screen 4852 by answering the two questions about how the amounts entered on the W-2 or 1099 were determined, and what efforts were made to obtain the forms.

Caution Form 4852 cannot be e-filed if the EIN is missing from the W-2; you must paper-file it. Completion of screen 4852 will not eliminate EF message 0122, which prevents e-filing.

Review Tax Topic 154 - Form W-2 and Form 1099-R (What to Do if Incorrect or Not Received) for more information about requirements.

Note The 4852 will not generate if tied to a W-2 past the first 30. If you have more than 30 Forms W-2, the substitute W-2 will need to be one of the first 30 on the list.