Drake Tax - 3115: Purpose of Form and Filing

Article #: 11627

Last Updated: December 05, 2024

Form 3115, Application for Change in Accounting Method, is an application to the IRS to change either an entity’s overall accounting method or the accounting treatment of any item.

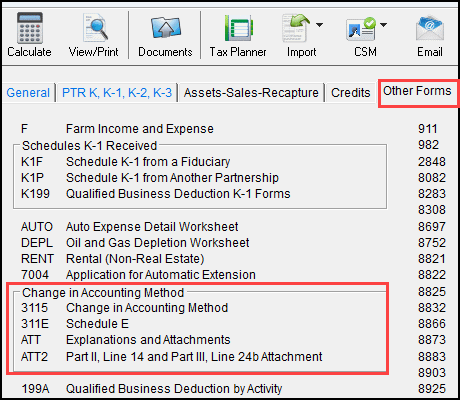

To complete Form 3115, open the return and complete screens as necessary under the Change in Accounting Method section found on the Other Forms tab in data entry of the 1065, 1120-S, and 990 and the second Other Forms tab in data entry of the 1120.

-

Links to other portions of Form 3115 are located at the top of the 3115 screen (parts I, II, III, IV, A, B, C, and D).

-

Data entry for the 3115 Schedule E is available on the 311E screen, not from a link within the 3115 screen.

-

ATT and ATT2 required explanations will appear on a STATEMENT when you view the return.

Information should be entered in either the Part I section or the Part III section, but not both. Part I, Information for Automatic Change Request, does not require the preparer's signature.

If only one field is completed on the Schedule A screen (A,B,C link at the top of the 3115 screen), the software automatically displays the word Statement #A2-A in the field on the generated form. Many of these fields require additional descriptions on the detail worksheet in data entry.

Form 3115, Application for Change in Accounting Method, is automatically attached and e-filed with the return in the Individual (1040), S corporation (1120-S), Corporation (1120), Partnership (1065), and Tax-Exempt (990) packages. Note that the Form 3115 Instructions also specify that a duplicate copy of the form must be submitted to the IRS separately.

Due to factors surrounding COVID-19, the IRS has implemented a temporary change to the duplicate filing guidelines for taxpayers filing under the automatic change procedure. See the IRS newsroom alert for additional information and a Q&A section.