Drake Tax - 8863: Education Benefits

Article #: 12153

Last Updated: February 17, 2026

The education credits, Lifetime Learning and American Opportunity Credits, can be taken only for a dependent, taxpayer, or spouse. There are limitations for each of these credits, discussed below. Lifetime Learning and American Opportunity credits are entered on the 8863 screen and education credits appear on Form 8863 in View/Print mode. The form is not produced in View/Print mode if the taxpayer does not qualify for the benefit.

Note Filing status cannot be Married Filing Separate (MFS).

Taxpayer or spouse cannot be the dependent of another.

The taxpayer cannot claim both credits for the same student in the same year.

Form 1098-T will assist you in entering AOTC or Lifetime Learning Credits.

-

Enter student details:

-

If the student is the taxpayer or spouse, enter their data on federal screen 1.

-

If the student is a dependent, enter their information on federal screen 2.

Important When the dependent is over 18, check the box Over 18, under 24, and a student under the Additional Information section.

-

-

Calculate the return.

-

On the 8863 screen, select the student’s SSN from the drop list under Student’s SSN.

-

Complete the 8863 screen.

-

If the same student attended multiple schools, use the Educational Institutions tab located at the top of the 8863 screen.

-

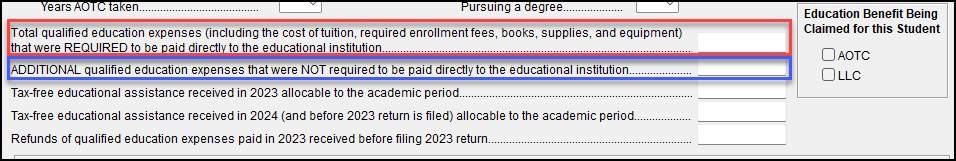

Enter in applicable expenses and education assistance amounts in the lines below question 26 on the screen (see below for details on expenses).

-

Select which education benefit is being claimed to have the software calculate the credit amount for the student. These check-boxes are mutually exclusive since two credits cannot be claimed for the same individual in the same year.

-

Question 22 parts (2) and (3) are the 1098-T lines under the information about the educational institution. These questions are located below the educational institution name and address sections.

-

Caution A separate 8863 screen is needed for each student for whom a credit is claimed.

Qualified Education Expenses

Per the 8863 Instructions, each credit only allows certain expenses to be included for the credit calculation. You can enter the amounts as applicable on the 8863 screen and Drake Tax will only carry the allowable amount to the form. This is why there are separate lines for expenses required to be paid (red) and additional expenses not required to be paid (blue) to the educational institution:

-

American opportunity credit: Qualified education expenses include amounts paid for tuition, fees, and course materials, which include books, supplies, and equipment needed for a course of study, whether or not the materials are purchased from the educational institution as a condition of enrollment or attendance.

-

Lifetime learning credit: Qualified education expenses include amounts paid for books, supplies, and equipment only if required to be paid to the institution as a condition of enrollment or attendance.

-

The credit will only be based on the amounts required to be paid (red box above).

-

Credit Comparison

The following chart is from the Form 8863 Instructions:

|

American Opportunity Credit |

Lifetime Learning Credit |

|

|---|---|---|

| Maximum credit | Up to $2,500 credit per eligible student | Up to $2,000 credit per return |

| Limit on modified adjusted gross income (MAGI) | $180,000 if married filing jointly; $90,000 if single, head of household, or qualifying surviving spouse | $180,000 if married filing jointly; $90,000 if single, head of household, or qualifying surviving spouse |

| Refundable or nonrefundable | 40% of credit may be refundable; the rest is nonrefundable | Nonrefundable—credit limited to the amount of tax you must pay on your taxable income |

| Number of years of post-secondary education | Available ONLY if the student had not completed the first 4 years of post-secondary education before 2025 | Available for all years of post-secondary education and for courses to acquire or improve job skills |

| Number of tax years credit available | Available ONLY for 4 tax years per eligible student | Available for an unlimited number of tax years |

| Type of program required | Student must be pursuing a program leading to a degree or other recognized education credential | Student doesn't need to be pursuing a program leading to a degree or other recognized education credential |

| Number of courses | Student must be enrolled at least half-time for at least one academic period beginning during 2025 (or the first 3 months of 2026 if the qualified expenses were paid in 2025 | Available for one or more courses |

| Felony drug conviction | As of the end of 2025 the student had not been convicted of a felony for possessing or distributing a controlled substance | Felony drug convictions don't make the student ineligible |

| Qualified expenses | Tuition, required enrollment fees, and course materials that the student needs for a course of study whether or not the materials are bought at the educational institution as a condition of enrollment or attendance | Tuition and required enrollment fees (including amounts required to be paid to the institution for course-related books, supplies, and equipment) |

| Payments for academic periods | Payments made in 2025 for academic periods beginning in 2025 or beginning in the first 3 months of 2026 | Payments made in 2025 for academic periods beginning in 2025 or beginning in the first 3 months of 2026 |

| TIN needed by filing due date | Filers and students must have been issued a TIN by the due date of their 2025 return (including extensions) | Students must have been issued a TIN by the due date of their 2025 return (including extensions) |

| Educational institution's EIN | You must provide the educational institution's employer identification number (EIN) on your Form 8863 | Educational institution’s employer identification number (EIN) is not required on your Form 8863 |

Credit Recapture

If the taxpayer received an education credit in an earlier year, but then received a refund of the qualified expenses on which the credit was based, they may be required to recapture the credit. Use screen 5, line 16(3). The literal ECR is shown on Form 1040, line 16. This increases the calculated total tax on the return.

Form 8863 Instructions provide more details about how to figure recapture for a refunded educational credit and explain when tax-free educational assistance may be considered a refund subject to recapture.