Drake Tax - GBC and 3800 Screens for General Business Credits

Article #: 13824

Last Updated: December 05, 2024

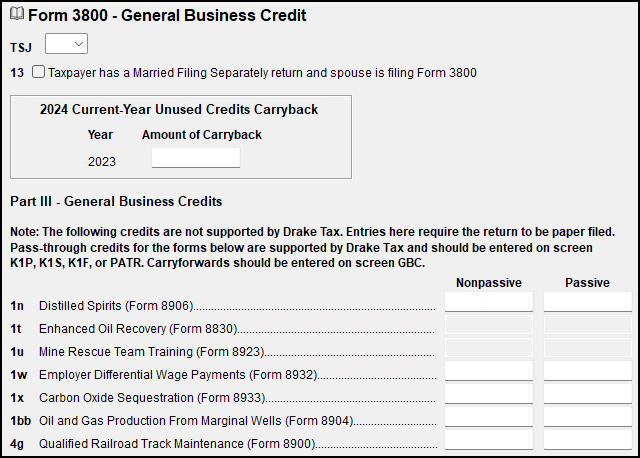

Screens 3800 (General Business Credit) and GBC (General Business Credit Carryovers) have been redesigned to simplify data entry of business credit carryforwards and carrybacks. Screen PACR (Passive Activity Credit Carryover) has been removed.

Pass-through business credits from partnerships, S corporations, trusts, or 1099-PATR that are supported by Drake Software are entered on K1P, K1S, K1F, or PATR screens, respectively.

Credits that are not supported by Drake Software can now be entered on screen 3800 in either the Nonpassive or Passive columns. Returns with these credits cannot be e-filed.

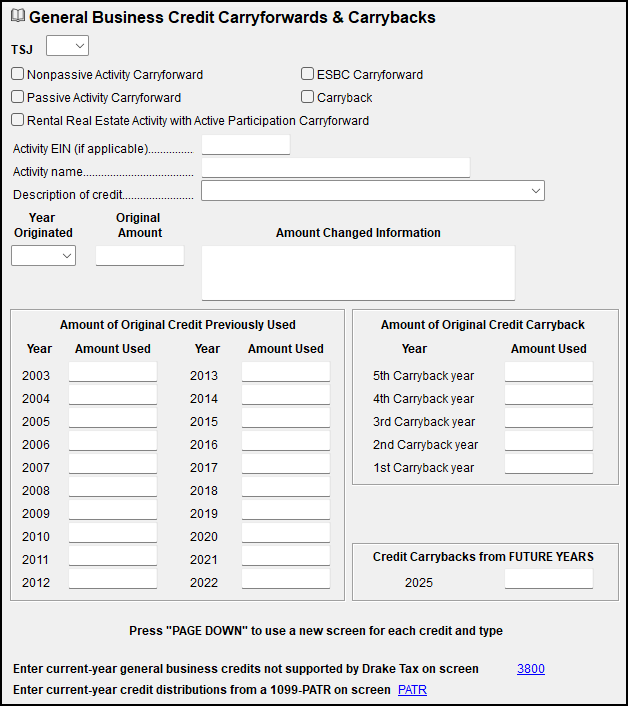

General Business Credit Carryforwards and Carrybacks are entered on the GBC screen.

Choose a credit from the Description of credit list. Press Page Down to enter each additional credit.

Carryforward amounts flow generally to Part I of Form 8582-CR, line 4 (which flows from Part III of Form 3800), and to any corresponding worksheets. The 8582-CR worksheet names begin Wks CR.