Drake Tax - 8829 - Office in Home

Article #: 11781

Last Updated: November 03, 2025

Note This article comprises former KB articles 11759, 10801, 12513, 12883, and 11781. It is herein referred to as KB 11781.

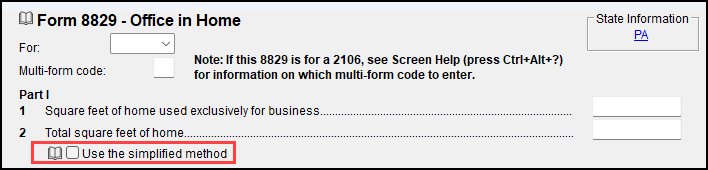

Use screen 8829 to report expenses associated with an office in the taxpayer's main home. Form 8829 is produced only when directed to a Schedule C using the For drop list at the top of the screen.

Note Enter each office in home on a separate 8829 screen with the correct square footage entered on lines 1 and 2 of each screen. Apportion expenses in either the direct or indirect field for the time the office was used during the tax year.

Screen 8829 also can be directed to a Schedule F, Form 2106 or to a K1P, in which case View/Print mode produces Wks 8829 rather than Form 8829.

When you direct screen 8829 to a:

-

Schedule C or F

-

if you haven't created the form, open screen C or F, select T or S from the TS box drop list, and complete any additional entries needed.

-

-

K1P

-

If you haven’t created the K1P, open screen K1P, select T or S from the TS box drop list, and complete any additional entries needed.

-

The literal UPE (Unreimbursed Partnership Expenses) appears on line 28(b) of Schedule E Part 2.

-

-

Form 2106

-

If you haven’t created the 2106, open screen 2106, select T or S from the TS box drop list, and complete any additional entries needed.

-

Mortgage interest and taxes flow directly to Schedule A, not to Wks 8829.

-

8829 Multi-form Code for Form 2106: If the 8829 is for a taxpayer's 2106, enter 1 in the Multi-form code field. If the 8829 is for a spouse's 2106 and the taxpayer does not have a 2106, enter 1 in the Multi-form code field. If the 8829 is for a spouse's 2106 and the taxpayer has a 2106, enter 2 in the Multi-form code field. If the 8829 is for a spouse's 2106 and the taxpayer has two 2106s (which prevents e-filing), enter 3 in the Multi-form code field.

-

For information about a home office related to a K1S, see Drake Tax - 1040 - Shareholder Unreimbursed Employee Expenses.

Part I

Exclusive Business Use

For exclusive business use areas, complete fields

-

1 Square feet of home used exclusively for business

-

2 Total square feet of home

The software calculates the percent business use for line 7.

Part-time Business Use

For part-time business use areas (day care activities that qualify for the exception to exclusive use), complete fields

-

2 Total square feet of home.

-

1, 4, and 5 in the Day Care Facilities Only area.

The software calculates the percent business use for line 7.

For day care activities that involve both exclusive and part-time use, either enter the data and let the software calculate the combined business use percentage, or calculate that percentage manually and enter the result as an override.

To have the software calculate the percentage, complete fields 1 and 2 as above for exclusive business use areas, and complete fields 1, 4, and 5 in the Day Care Facilities Only area as above for part-time business use areas. The software calculates the percent business use for line 7, produces the required statement explaining the calculation, and annotates line 7 on the 8829.

Tip To override line 7 with your own percentage calculation, enter your calculated percentage in field 7 in the Day Care Facilities Only area. For example, enter 6.25% as 6.25. If you use the override, you must also prepare an explanatory statement. Click SCH to open a worksheet to add the required explanation of the percentage figure. From the Type of attachment/statement number and title drop list select 775 - 8829, Ln 7, Business Percent and enter an explanation. In View/Print mode, confirm that the software has annotated line 7.

Part II

Direct Expenses

Direct expenses are entirely attributed to the business activity in the home.

Indirect Expenses

Indirect expenses are for the entire home, which the software allocates between business and non-business use based on the ratio derived in Part I. On lines 9, 10 and 11 enter only expenses that would otherwise be deductible. That part allocated to personal use will flow to Schedule A, unless you check the option Do not carry personal portion of interest and taxes to Schedule A.

Note Casualty losses: For line 9 entries, review the calculated results in View/Print mode for line 35 of Form 8829. Form 8829 Instructions for line 35 direct that amount to be entered on line 27 of Form 4684. In that event, you must prepare Form 4684 manually and paper-file the return.

Part III - Depreciation

You can enter depreciation data either on screen 4562 and point it to the 8829 screen (using the For box), or you can enter the data directly on screen 8829.

Caution If the home was placed in service in the current year, and you have section 179 expense from any activity in the return, you must enter home depreciation data on screen 4562 to prevent e-file rejection. See Drake Tax - 1040: EF Message 5570 for details.

If you omit Form 4562, and want to enter the depreciation directly in Part III on screen 8829, you must enter the basis, FMV, and land information required by line 37. You must also enter either

-

the date the home was placed in service

-

the depreciation percentage (an override field)

The software can calculate the correct depreciation percentage from the data entered, but the override can be used instead if you know the correct percentage rate.

Important If the taxpayer is depreciating assets in addition to the home itself, enter the home on Form 4562, rather than Part III of Form 8829.

Simplified Method

Taxpayers may elect to use a simplified method (instead of actual expenses) when figuring the deduction for business use of their home. To elect the simplified method,

-

on the 8829 screen, select the applicable form or schedule in the For drop list.

-

Enter a Multi-Form code, if applicable.

-

Enter the square footage of office on line 1,

-

Enter the total square footage of the home on line 2.

-

Select the check box Use the simplified method.

When the taxpayer elects to use the simplified method, Form 8829 is not produced; the calculated amount will flow to the applicable schedule instead. The calculation is shown Form 8829 - Simplified in View/Print mode.

-

Schedule C, line 30

-

Schedule E, line 19

-

Schedule F, line 32

-

Form 2106, line 4

-

Schedule E, page 2, line 28 as UPE (Unreimbursed Partnership Expenses)

-

Form 4835, line 30

Part-year Calculation

If the office-in-home was only used for part of the year, complete the 8829 screen as above. Then, enter either the Date placed in service or the Date taken out of service in part III.

Note This can only be used for one 8829 screen. Per Publication 587, "If you used more than one home in your business during the year (for example, you moved during the year), you can elect to use the simplified method for only one of the homes. You must figure the deduction for any other home using actual expenses."

In this circumstance, the total deduction still flows to the schedule and the calculation displays on the worksheet Form 8829 - Simplified. In addition, a note explaining the amount on line 2 allowable square footage includes the multiplier as a decimal (figured by number of months in service, divided by 12).

For example, a 200 square foot amount entered on the 8829 screen is reduced to only 83 square feet allowed because the office was only used for 5 months out of the year (January-May). 300 x (5/12) = 83. This follows the guidelines from Publication 587, page 26 for part II of the Area Adjustment Worksheet.

Prior-Year Carryover

If the taxpayer uses the simplified method on screen 8829, prior year credit cannot be used, and there is no carryover to next year. The taxpayer can use a prior year credit in a succeeding year when safe harbor is not used. See the references to using the "simplified method" in the Instructions for Form 8829 and Publication 587, Business Use of Your Home.

The prior-year credit is not carried forward on WKs CARRY. You should note the credit on the NOTE screen in Drake Tax so a reminder will update to next year's return.

For more information see:

-

The IRS website Simplified Option for Home Office Deduction. This site offers a comparison of the simplified option and the regular method.

More Than One Asset

Only one asset entered on screen 4562 with Main home for Form 8829 selected will flow to Part III Depreciation of Your Home on Form 8829, Office in Home.

If the depreciation from more than one 4562 should flow to the 8829 as part of the main home (such as improvements, including replacing electrical wiring or plumbing, adding a new roof or addition, paneling, or remodeling) enter the assets on the 4562 screen and point them to the 8829 using the FOR field. Do not mark them as Main home for Form 8829.

When the return is viewed, a reference to an attachment should appear on line 42 (line 41 in Drake Tax 2017 and prior) of Form 8829, "SEE ATT 8829". The attachment will provide item detail for the depreciation amount listed on Form 8829 (other than the main home itself).

See the Instructions for Form 8829 for more information. Also see Publication 587.