Drake Tax - 2441 - Child and Dependent Care Credit

Article #: 11750

Last Updated: February 04, 2026

Form 2441, the Child and Dependent Care Credit, appears in a 1040 return. Choose from the following sections to learn more.

Entering the Credit

-

On screen 2, enter:

-

the dependent's details, and

-

the amount of childcare expenses incurred and paid for that dependent.

-

If any qualifying expenses were provided by the employer, enter the applicable amount related to that child.

-

-

Repeat this process for any additional dependents for whom childcare was provided.

-

Note: If a taxpayer is claiming the credit for a disabled spouse, enter the spouse on screen 2 as a dependent, select OTHER from the Relationship drop list, and check the options Disabled and Not a dependent. If the spouse has no earned income, see below.

-

-

-

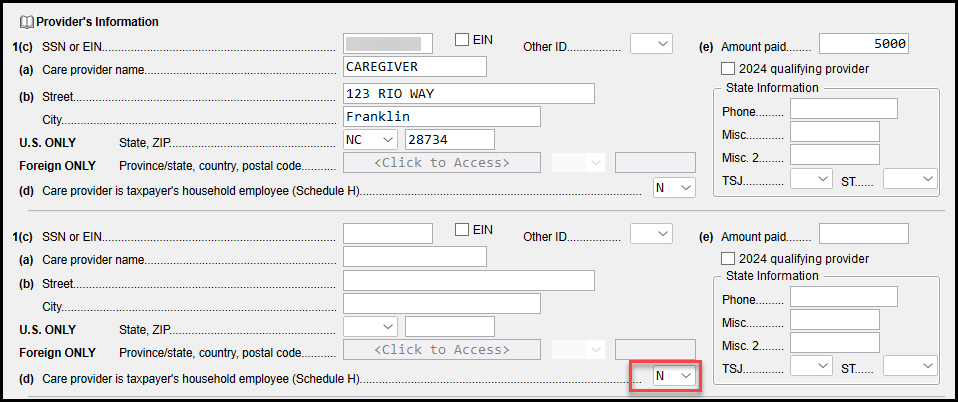

On screen 2441, enter the care provider's details including the total amount paid to that provider. If there were multiple providers, details can be entered for three on a single 2441 screen.

-

Ensure that the total expenses reported on all screens 2 equals the total paid to provider(s) reported on screen 2441.

-

You must also select whether or not the care provider was a household employee (EF Message 0137).

-

-

On screen W2, enter employer contribution information in box 10, if applicable.

If there were 2024 expenses paid in 2025, use the link beside line 9bon the 2441 screen to enter details. In View/Print mode, Wks 2441 calculates the amount to report on Form 2441, line 9b.

Disabled or Full-Time Student

For a spouse who qualifies for the credit, but is a full time student or disabled, IRS rules attribute a certain amount of earned income to the spouse for purposes of the credit. To enter these amounts, use the taxpayer and spouse adjustment fields at the bottom of screen 2441, labeled 4, 5, 18, 19 Earned Income for 2441 purposes ONLY. The entry can be up to the $3,000 allowed for one child or $6,000 for 2 or more dependents. Multiply $250 by the number of months disabled or a full-time student up to $3,000 for one child or $500 times months up to $6,000 for two or more dependents. The IRS provides a more detailed example in the Form 2441 Instructions. Also check the box at the top of the 2441 screen that Taxpayer or spouse was a student or was disabled...

No Credit Calculated

If Form 2441 is not calculating a credit, check the following items:

-

Make sure that the amounts paid to the provider are entered on the 2441 screen and on screen 2 (Dependents). The totals from the two screens must match.

-

There must be earned income for the credit to calculate.

-

Earned income includes wages, salaries, tips, and other taxable employee compensation, and net earnings from self-employment.

-

Note that any net losses from self-employment reduce the total earned income from other sources.

-

There are exceptions for a disabled taxpayer, or a taxpayer who is a student. See above for details on this exception.

-

If the Filing Status is Married Filing Joint (MFJ), both the Taxpayer and Spouse must have earned income.

-

-

If Filing Status is Married Filing Separate (MFS), the taxpayer does not qualify for the credit unless certain conditions are met involving legal separation and spouses living apart from each other (see the "Joint Return Test" in Publication 503).

-

This is a non-refundable credit. If the tax liability is already 0 (zero), there is nothing to which to apply the credit. Child Care Credit is limited to the tax liability on the return. If the tax liability is $0 then the Child Care Credit is $0.

-

If there are employer provided Dependent Care Benefits, check the calculation on Form 2441, page 2. Only dependent care amounts in excess of the Dependent Care Benefits qualify for the credit. If Dependent Care Benefits are greater than amounts paid for child care the excess is shown as taxable income on the 1040, Line 1 (DCB is printed in the margin to the left of line 1).

Page 2 of the 2441 (Part III) does not produce unless employer contribution information is entered in box 10 of the W2 screen or line 12 of screen 2441.

Common EF Messages

0137

If you have completed all required fields for a provider, this message may be caused by an erroneous entry in another provider section. For example:

5066

If the taxpayer did not have any child care expenses this year, enter a 0 (zero) on line 16 of the 2441 screen. This produces Form 2441 with 0 expenses and adds the amount from box 10 of the W2 to the amount on line 1 of the 1040. The box 10 amount is added to taxable income because there were no child care expenses and tax was not withheld by the employer.

Note To include a dependent on Form 2441 who has no child care expenses, go to screen 2 Dependents and enter 0 (zero) in that dependent's field Qualifying childcare expenses incurred and paid in 2025 and check the box Include dependent on Form 2441 without qualified expenses (check box added in Drake Tax 2023).

5130

In order to clear this EF message, return to the 2441 Child Care Credit screen. The SSN/EIN field is a required entry for this credit to be available. Enter the Social Security Number or Employer Identification Number of the child care provider. If the value is an EIN, check the EIN box beside the entry to indicate that it is an EIN.

If the SSN/EIN is not available, one of these non-numeric codes may be applicable:

-

T - TAXEXEMPT: if the provider is a tax-exempt organization.

-

L - LAFCP: if the taxpayer/spouse is living abroad and the child care provider is not required to have an identifying number enter this acronym for "Living Abroad Foreign Care Provider."

-

R - REFUSED: if the child care provider refuses to give a SSN/EIN.

-

U - UNABLE: if the child care provider has moved and you are unable to find the SSN/EIN.

Notes in View

When a return contains Form 2441, Child and Dependent Care Expenses, the following NOTES may be generated:

"Child Care Amounts Differ"

This note appears when:

-

there is an amount in box 10 (dependent care benefits) on screen(s) W2, and/or an amount on screen 2441, line 22, and

-

either the amount from the W2(s), box 10, and/or any amount entered on line 22 of screen 2441, does not match the total Portion of qualifying expenses provided by the employer entered on screen 2 for all dependents; or, the total Portion of qualifying expenses provided by the employer entered on screen 2 for all dependents exceeds the allowed exclusion amount ($5,000).

When this occurs, the note is provided in order to tell you that the software may have apportioned the employer-provided care on line 2, column c of the 2441 differently from the amounts entered on the dependent screens. In order to determine the total amount of expenses to be reported on line 2, column c, the software will take the total childcare expenses, and then subtract out the amount found on line 28 of the 2441 form (which will not exceed $5,000). (This calculation follows the instructions printed on line 30 of the 2441). The note goes on to explain how the software will then allocate the remaining amount among the dependents.

If the amount in box 10 of the W2 is greater than the amount of childcare expenses, or is greater than the $5,000 exclusion limit, the remainder will appear on Form 1040, line 1 (line 7 in 2017 and prior), with the literal DCB, dependent care benefits, because it is taxable income.

"Child Care Expense Totals Differ"

This note appears when the total of dependent care expenses entered on screen 2 for all dependents does not equal the total entered on screen 2441.

Additional Considerations and Resources

-

The taxpayer’s credit is reduced by dependent care benefits provided by an employer under a qualified plan. This amount is reported on Form W-2, box 10. Such benefits, up to a $5,000 limit, are also excluded from taxable income. Any amount above the $5,000 limit (or above the taxpayer’s qualified expenses, the taxpayer’s or the spouse’s earned income, whichever is smallest) appears as follows, depending on the year of Drake Tax:

-

Form 1040, line 1e as Taxable dependent care benefits from Form 2441, line 26 in Drake22 and future.

-

Form 1040 as income with the literal DCB (Dependent Care Benefits) beside the line in Drake21 and prior.

-

-

A dependent may still be considered a qualifying child even if they do not have current year expenses. See the IRS definition of a qualifying person in the 2441 Instructions for details. If this applies, enter a zero for Qualifying Childcare Expenses in 20YY on screen 2 for that dependent.

-

The dependent must be under age 13 or totally and permanently disabled. For a dependent over 13, the software assumes that the dependent is disabled and qualifies for the credit. It generates a note suggesting you review the child’s qualifications.

-

The length of the child-care provider's name field is dictated by IRS EF requirements, and cannot be expanded.

-

DC does not allow e-filing if a foreign country is listed for a provider on the 2441.

See Publication 503, Child and Dependent Care Expenses for details. For more information about the Child and Dependent Care credit, or exclusion, and other limitations see the 2441 Instructions.