QBI - Form 8995-A - Schedule C Loss Netting and Carryforward

Article #: 16616

Last Updated: December 31, 2025

Per IRS guidelines, if any of the trades, businesses, or aggregations have a qualified business loss, those losses must be apportioned among all the trades or businesses with QBI in proportion to their QBI. Thus the amount in Form 8995-A, Schedule C, column B is calculated based on the total loss amount allocated to each business based on the ratio of the trade or business income for each qualifying trade or business to the total trade or business income on the return.

Note This article refers to Form 8995-A Schedule C which may contain information relating to qualified business income originating from a partnership Schedule K-1 (K199 screen), S corp K-1 (K199screen), Schedule C (self-employed income, C screen), Schedule E (rental income, E screen), Schedule F (farm income, F screen), etc.

Use the following simplified examples as an illustration.

Current year positive income from multiple activities with a prior year QBI loss carryforward.

-

A single taxpayer's taxable income before the QBI deduction is more than the threshold, thus he is required to use the Form 8995-A instead of Form 8995 to calculate his QBI.

-

He has a K1P and a K1S with a K199 screen completed for each business showing an ordinary income as follows:

-

K1P: $50,000

-

K1S: $200,000

-

-

A QBI carryforward of $10,000 from the prior year has been entered on the QBI screen.

-

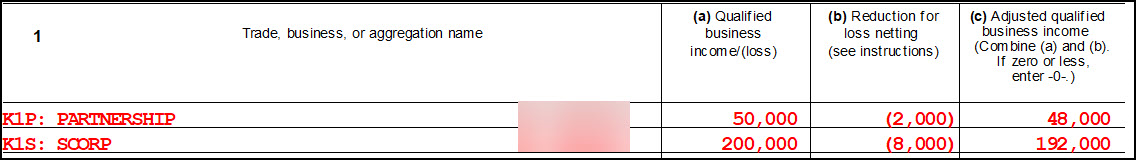

Form 8995-A Schedule C produces as follows:

Note Column A shows the business income for each activity as entered on the K199 screens, respectively.

The software automatically calculates the amount of loss to allocate to each business by first determining how much of the total income for which each business is responsible. In this example, the total between all businesses is $250,000.

-

The partnership reported $50,000 or 20% of the total income (50,000/250,000= 0.20).

-

The S corp reported $200,000 or 80% of the total income (200,000/250,000= 0.80).

This ratio is then applied to the loss to determine how much carries to column B for each business.

-

The partnership shows a loss of $2000 in column B ($10,000 X 0.20= $2,000).

-

The S corp shows a loss of $8000 ($10,000 X 0.80= $8,000).

The loss is then subtracted from the income to determine the adjusted qualified business income (column C) and those are the amounts that carry to Form 8995-A, Part II, line 2.

Example 2

Current year income and losses from multiple activities with a prior year QBI loss carryforward.

-

A single taxpayer's taxable income before the QBI deduction is more than the threshold, thus he is required to use the Form 8995-A instead of Form 8995 to calculate his QBI.

-

He has the following trades or businesses showing ordinary income and loss as follows:

-

K1P: $50,000

-

K1S: $200,000

-

Schedule C: -$2500

-

-

A QBI carryforward of $10,000 from the prior year has been entered on the QBI screen.

-

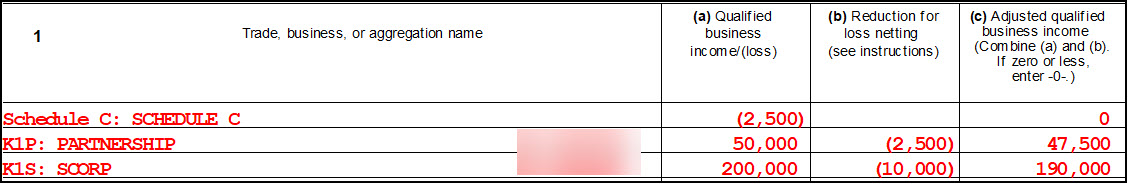

Form 8995-A Schedule C produces as follows:

Note Column A shows the business income or loss for each activity as entered on the K199 screens, and calculated on the Schedule C, respectively.

The software automatically calculates the amount of loss to allocate to each business by first determining how much of the total income for which each business is responsible. In this example, the total positive income between all businesses is $250,000.

-

The partnership reported $50,000 or 20% of the total income (50,000/250,000= 0.20).

-

The S corp reported $200,000 or 80% of the total income (200,000/250,000= 0.80).

-

The Schedule C reported $0 or 0% of the total income.

This ratio is then applied to the total loss (current year plus carryover) to determine how much carries to column B for each business. The total losses from all activities and carryovers equal $12,500. This is also shown on Form 8995-A Schedule C, line 3.

-

The partnership shows a reduction for loss netting of $2500 in column B ($12,500 X 0.20= $2500).

-

The S corp shows a reduction for loss netting of $10,000 ($12,500 X 0.80= $10,000).

-

The adjusted QBI for the Schedule C is zero as the loss was netted with the income from the other businesses or trades.

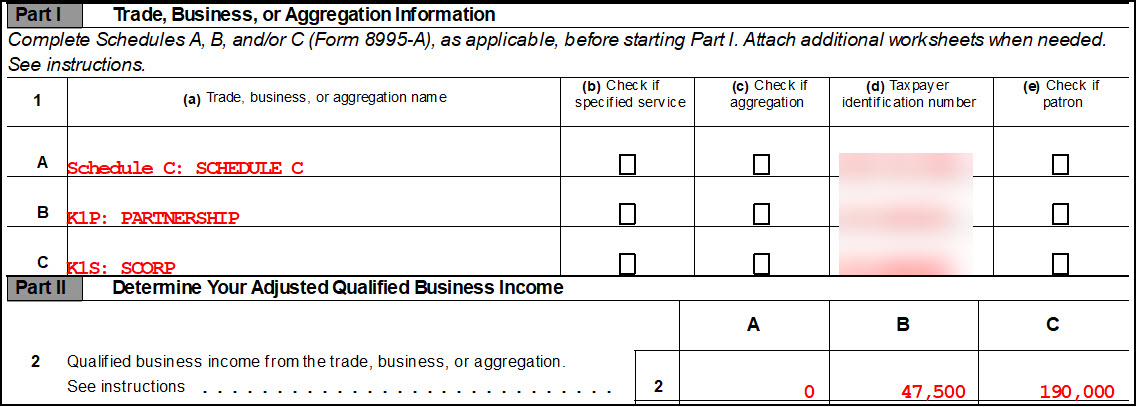

The loss is then subtracted from the income to determine the adjusted qualified business income (column C) and those are the amounts that carry to Form 8995-A, Part II, line 2.

QBI Thresholds

-

2025: $197,300 or $394,600 (MFJ)

-

2024: $191,950 or $383,900 (MFJ)

-

2023: $182,100 or $364,200 (MFJ)

-

2022: $170,050 or $340,100 (MFJ)

-

2021: $164,900 or $164,925 (MFJ)

For more information, see the Form 8995-A Instructions.