Drake Tax - 1065 - Calculating Book Income, Schedules M-1 and M-3

Article #: 10409

Last Updated: November 03, 2025

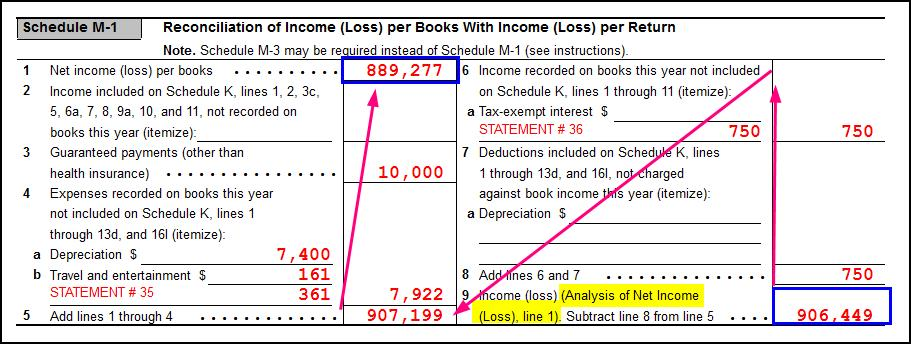

Schedule M-1 is required when the gross receipts of the partnership are greater than $250,000, or the total assets are greater than $1,000,000. The calculation for Schedule M-1 is done in reverse from the form itself. Schedule M-1, line 1, “Net income (loss) per books,” is not available without book-to-tax adjusting entries. The calculation for the Form 1065, Schedule M-1, is as follows:

-

Line 9

-

Add line 7

-

Add line 6

-

Subtract line 4

-

Subtract line 3

-

Subtract line 2

The end result reported on Schedule M-1, line 1, should match the amount reported on the financial reporting statements for the partnership’s book income.

Amount Origins

Line 2, “Income included on Schedule K, lines 1, 2, 3c, 5, 6a, 7, 8, 9a, 10, and 11, not recorded on books this year” - Certain credit forms require that the amount of credit be included in other income. The increased income is a tax item only and is not generally included in book income. The increased income amount flows to this line automatically. Additional income items reported for tax purposes, but not included in book income, are entered on the M1 screen, line 2.

Line 3, “Guaranteed payments” - This is the amount of guaranteed payments, excluding health insurance amounts, included on Schedule K, line 4. Guaranteed payments are entered on:

-

the DED screen, line 10, “Guaranteed payments to partners,”

-

the 8825 screen, line 15, “Other, Guaranteed payments,”

-

the RENT screen, line 16, Other expenses, “Guaranteed payments.”

-

There is no override for this line.

Line 4a, “Depreciation” - This is the book-to-tax adjustment for depreciation that is made when book depreciation is greater than tax depreciation. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 4, “Book-to-tax depreciation adjustment.”

Line 4b, “Travel and entertainment” - Meals and entertainment limitations are carried from amounts entered on the DED screen.

Line 4 - “Expenses recorded on books this year not included on Schedule K, lines 1 through 13d, and 16l,” other than depreciation and travel and entertainment, flow automatically from amounts entered on the return. This line can be adjusted on the M1 screen, line 4, “Other.” The amounts that are carried automatically by the program are:

-

Certain credit forms that require that the amount of credit reduce the expense attributable to the credit. The program automatically reduces the expense amount for Form 1065, page 1, lines 9, 14, or 20, depending on the credit type. The decreased expense is a tax item only and does not generally decrease the book expense. The decreased expense amount book-to-tax adjustment is carried to this line automatically. Additional expense items reported for book purposes, but not deducted on the return, are entered on the M1 screen, line 4, “Other.”

-

Certain nondeductible expenses, such as penalties and fines, and other nondeductible expenses entered on the bottom of the INC screen, in the Form 1065, Schedule K - Most Common Items section or the second K screen (go to the screen K and press Page Down), line 18c.

-

The amortization book-to-tax adjustment is made when book amortization is greater than tax amortization. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 4, “Book-to-tax amortization adjustment.”

Line 6a, “Tax-exempt interest” - This includes interest, such as interest received on state or local bonds, and is excluded from gross income. The amount is entered on the second K screen (go to screen K and press Page Down), line 18a.

Line 6 - Includes other income reported on the partnership’s books for the year but excluded from the tax return. These include certain gains on certain installment sales. Amounts entered on the M1 screen, line 6, “Other” adjust those amounts carried from the K1P screen, line 18, code B.

Line 7a, “Depreciation” - This is the tax-to-book adjustment for depreciation that is made when tax depreciation is greater than book depreciation. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 7, “Tax-to-book depreciation adjustment.”

Line 7 - “Deductions included on Schedule K, lines 1 through 13d, and 16l, not charged against book income this year,” other than depreciation and amortization adjustments, are entered directly on the M1 screen, line 7, “Other.” No amount is carried to this line automatically.

Line 7 - The amortization tax-to-book adjustment is made when tax amortization is greater than book amortization. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 7, “Tax-to-book amortization adjustment.”

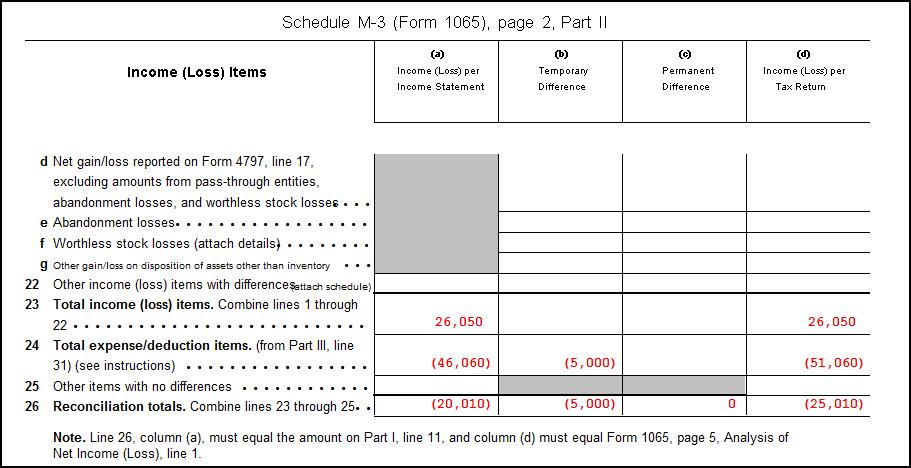

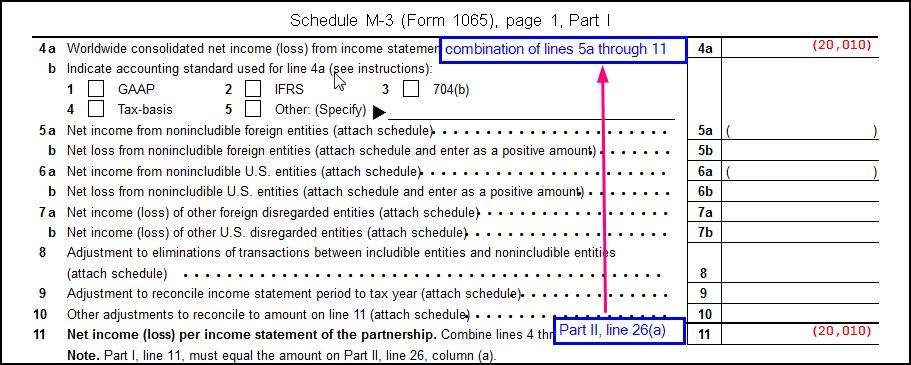

Schedule M-3

Schedule M-3 is required when the partner’s total assets or adjusted total assets at the end of the tax year is equal to $10 million or more, or the partnership’s total receipts for the tax year is $35 million or more. The calculation for Schedule M-3 is done in reverse from the form itself. The first step in the calculation is the equalization of the taxable income reported on Schedule M-3, Part II, line 26, column (d), which must match Form 1065, page 5, Analysis of Income, line 1. Until that amount is correct, the book income reported on Schedule M-3, Part I, line 4a, will be wrong.

The program makes the calculation for Schedule M-3, Part I, line 4a, in the following manner:

-

Page 1, Part I, line 11 is determined by page 2, Part II, line 26, column a, which is calculated in the following manner:

-

Page 2, line 26, column d

-

Page 2, line 26, column c

-

Page 2, line 26, column b

-

Page 2, line 26, column a

-

-

Subtract the positive amount from Part I, line 10, and add the negative amount from Part I, line 10 entered on the M3 screen

-

Subtract the positive amount from Part I, line 9, or add the negative amount from Part I, line 9 entered on the M3screen

-

Subtract the positive amount from Part I, line 8, or add the negative amount from Part I, line 8 entered on the M3S screen

-

Subtract the positive amounts from Part I, lines 7a and 7b, and add the negative amounts from Part I, lines 7a and 7b entered on the M3S screen

-

Subtract the positive amount from Part I, line 6b, and add the negative amount from Part I, line 6a entered on the M3S screen

-

Subtract the positive amount from Part I, line 5b, and add the negative amount from Part I, line 5a entered on the M3S screen

The end result reported on Schedule M-3, Part I, line 4a, should match the net income (loss) amount reported on the partnership’s worldwide consolidated net income statement.

For more information, review the Form 1065 Instructions.