Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

Article #: 10414

Last Updated: November 03, 2025

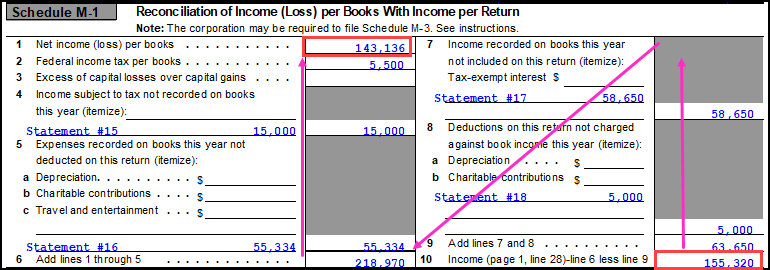

Schedule M-1 is required when the corporation's gross receipts or its total assets at the end of the year are greater than $250,000. The calculation for Schedule M-1 is done in reverse from the form itself. The taxable income reported on Schedule M-1, line 10, is available from the calculation of Form 1120, page 1, line 28; Schedule M-1, line 1, “Net income (loss) per books,” is not available without book-to-tax adjusting entries. The calculation for the Form 1120, Schedule M-1, is as follows:

-

Line 10

-

Add line 8

-

Add line 7

-

Subtract line 5

-

Subtract line 4

-

Subtract line 3

-

Subtract line 2

The end result reported on Schedule M-1, line 1, should match the amount reported on the financial reporting statements for the corporation’s book income.

Where do the amounts come from?

-

Line 2, “Federal income tax per books” - This is the tax calculated by the program and reported on Form 1120, page 3, Schedule J, line 4. The amount can be overridden on the M1 screen.

-

Line 3, “Excess of capital losses over capital gains” - This is the amount of capital losses in excess of capital gains. Corporations are not allowed to take capital losses, unlike an individual who can deduct up to $3,000 per year for capital losses. The amount is determined from Schedule D. Entries are made on the D screen. There is no override for this line.

-

Line 4, “Income subject to tax not recorded on books this year” - Certain credit forms require that the amount of credit be included in other income. The increased income is a tax item only and is not generally included in book income. The increased income amount flows to this line automatically. Additional income items reported for tax purposes, but not included in book income, are entered on the M1 screen, line 4.

-

Line 5a, “Depreciation” - This is the book-to-tax adjustment for depreciation that is made when book depreciation is greater than tax depreciation. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 5, “Book-to-tax depreciation adjustment.”

-

Line 5b, “Charitable contributions” - Charitable contribution deductions are limited to 10% of taxable income. When the contribution amount exceeds the limitation, the disallowed amount is included on line 5b. Charitable contribution deduction limitation calculation is based on entries on the DED screen, and reported on the Wks Contrib, Contribution Limitation/Carryover Worksheet, line 1E. There is no override for this line.

-

Line 5c, “Travel and entertainment” - Meals and entertainment limitations are carried from amounts entered on the DED screen.

-

Line 5 - “Expenses recorded on books this year not deducted on this return” other than depreciation and travel and entertainment, flow automatically from amounts entered for the return. This line can be adjusted on the M1 screen, line 5, “Other.” The amounts that are carried automatically by the program are:

-

Certain credit forms that require that the amount of credit reduce the expense attributable to the credit. The program automatically reduces the expense amount for Form 1120, page 1, lines 13, 17, or 26, depending on the credit type. The decreased expense is a tax item only and does not generally decrease the book expense. The decreased expense amount book-to-tax adjustment is carried to this line automatically. Additional expense items reported for book purposes, but not deducted on the return, are entered on the M1 screen, line 5, “Other.”

-

Amortization book-to-tax adjustment is made when book amortization is greater than tax amortization. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 5, “Book-to-tax amortization adjustment.”

-

-

Line 7, “Tax-exempt interest” - This includes interest, such as interest received on state or local bonds, and is excluded from gross income. The amount is entered on the INC screen.

-

Line 7 - “Income reported on the corporation’s books for the year but excluded on this tax return” includes life insurance proceeds and gains on certain installment sales. Amounts entered on the M1 screen, line 7, “Other” adjust those amounts carried from the K1P screen, line 18, code B.

-

Line 8a, “Depreciation” - This is the tax-to-book adjustment for depreciation that is made when tax depreciation is greater than book depreciation. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 7, “Tax-to-book depreciation adjustment.”

-

Line 8b, “Charitable contributions” - Charitable contribution deductions are limited to 10% of taxable income. When a contribution carryover from a prior year is allowed as a deduction on the current-year return, the allowed amount is included on line 8b. The current-year charitable contribution deduction allowed calculation is based on entries on the DED screen, and the LOSS screen, “Contribution Carryovers,” and is reported on the Wks Contrib, Contribution Limitation/Carryover Worksheet, lines 2(a-e)B and 5(a-o)B. There is no override for this line.

-

Line 8 - “Deductions allowed on the return and not charged against book income,” other than depreciation, charitable contributions, and amortization adjustments, are entered directly on the M1 screen, line 8, “Other.” No amounts are carried to this line automatically.

-

Line 8 - The amortization tax-to-book adjustment is made when tax amortization is greater than book amortization. The program makes the adjustment automatically based on entries in the return. The amount calculated by the program can be overridden on the M1 screen, line 8, “Tax-to-book amortization adjustment.”

Schedule M-3

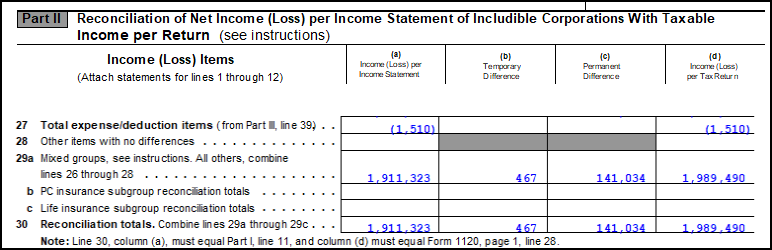

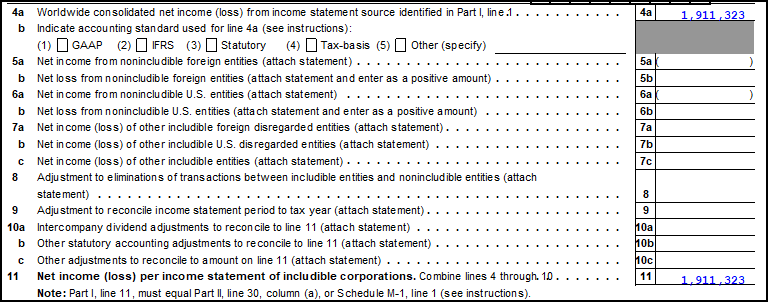

Schedule M-3 is required when the corporation’s total assets at the end of the year are $10 million or more. The calculation for Schedule M-3 is done in reverse from the form itself. The first step in the calculation is the equalization of the taxable income reported on Schedule M-3, Part II, line 30, column (d), which must match Form 1120, page 1, line 28. Until that amount is correct, the book income reported on Schedule M-3, Part I, line 4a, will be wrong.

The program makes the calculation for Schedule M-3, Part I, line 4a, in the following manner:

-

Page 1, Part I, line 11, is determined by page 2, Part II, line 30, column a, which is calculated in the following manner:

Page 2, line 30, column d

- Page 2, line 30, column c

- Page 2, line 30, column b

Page 2, line 30, column a

-

Subtract the positive amounts from Part I, lines 10a, 10b, and 10c, and add the negative amounts from Part I, lines 10a, 10b, and 10c entered on the M3S screen

-

Subtract the positive amount from Part I, line 9, or add the negative amount from Part I, line 9 entered on the M3S screen

-

Subtract the positive amount from Part I, line 8, or add the negative amount from Part I, line 8 entered on the M3S screen

-

Subtract the positive amounts from Part I, lines 7a, 7b, and 7c, and add the negative amounts from Part I, lines 7a, 7b, and 7c entered on the M3S screen

-

Subtract the positive amounts from Part I, line 6b, and add the negative amount from Part I, line 6a entered on the M3S screen

-

Subtract the positive amounts from Part I, line 5b, and add the negative amount from Part I, line 5a entered on the M3S screen

The end result reported on Schedule M-3, Part I, line 4a, should match the net income (loss) amount reported on the corporation’s worldwide consolidated net income statement.

For more information, see the 1120 Instructions.