Drake Tax - VA: EF Message 0111 Low Income Credit - MFS Return

Article #: 10588

Last Updated: November 03, 2025

Virginia requires the spouse's VA AGI to be included on a married filing separate (MFS) return. Failure to include this information results in EF Message 0111.

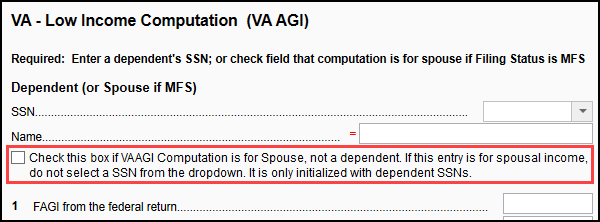

If the spouse's information is available, return to VA data entry, Credits tab > LOW (Low Income Credit) screen. For spouse computation, check the box indicating this entry is for the spouse and do not include a Social Security Number (as the SSN field is only for dependents).

Enter the VA AGI from the spouse's VA Form 760, Line 9. Only one spouse may claim the credit for low income. If the spouse was not required to file a Virginia Form 760, compute your spouse’s VA AGI as if the spouse is required to file a Virginia Form 760 resident return and enter on line 1 of this screen.

If the spouse's VA AGI is not available, or the credit should not be allowed, select the option Not eligible for Low Income Credit at the bottom of VA > screen 2 (Demographic Info - Additional Information).