Drake Tax - IN: Applying Property Tax

Article #: 10907

Last Updated: December 05, 2024

If property tax from federal Schedule A (Itemized Deductions), line 5b, is not being applied to Schedule 2, line 2, of the Indiana IT-40 return, or Schedule C, line 2 of the IT-40PNR please read the following information.

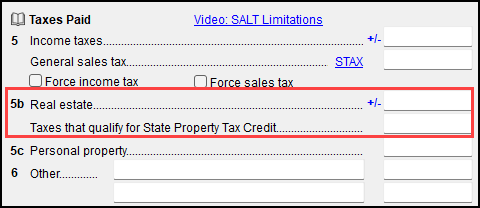

To apply the property tax from Schedule A, line 5b, to Indiana Schedule 2 or Schedule C, line 2, you must enter property tax information into two fields on federal screen A:

Real Estate--Enter the property taxes to be deducted on Schedule A of the federal return.

Taxes that qualify for State Property Tax Credit--Enter the appropriate amount to be applied to Indiana Schedule 2 or Schedule C, line 2.

You can also use the SCH2 screen (Amount of property tax paid field) in the Indiana program to enter the amount that qualifies for the Schedule 2 or Schedule C deduction.

Notes:

-

If a state property tax amount is entered on both the federal screen A and the Indiana screen SCH2, the SCH2 amount will override the screen A amount.

-

For part-year and nonresident returns, the federal screen A must have the state code set to IN for the amount to flow automatically to Schedule 2 or Schedule C.