Drake Tax - NM - NMBTIN

Article #: 11917

Last Updated: December 05, 2024

New Mexico requires anyone engaged in business in New Mexico to register with the Taxation and Revenue Department. During registration, each business will be provided with a State Tax ID number, also known as a New Mexico Business Tax ID Number (NMBTIN). This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

Employees who receive a W-2 from a firm or company are not required to apply for their own NMBTIN. Instead, these employees will be allowed to use the firm’s NMBTIN when preparing returns.

Anyone meeting the definition of a contractor must apply for their own NMBTIN. These contractors will not be permitted to use the firm’s NMBTIN.

To apply for a CRS ID number or for more information on the topic, visit NM’s website at https://www.tax.newmexico.gov/businesses/who-must-register-a-business/.

Entry

The NMBTIN may be entered under the State ID number in Setup > Firm > Settings tab.

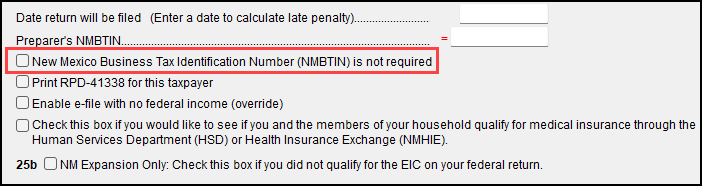

If you are not required to have a NMBTIN , check the box at the bottom of NM screen 1.

If the number is missing or incorrect, you may see NM EF Message 0471 when viewing the return.