Drake Tax - OH - Entering K-1 Pass-through Income

Article #: 13408

Last Updated: December 05, 2024

In an individual return, you can enter Ohio pass-through income and percentage ownership on either the federal K1 screen (K1P, K1F or K1S) or the Ohio PASS screen.

Note Do not enter the same information on both screens. If you enter the same pass-through income on both screens, the data will be duplicated in the Ohio return and result in an inaccurate credit amount.

The federal K1 screen can be used for single or multiple K-1s. It can also be used if there is no federal K-1 information to enter.

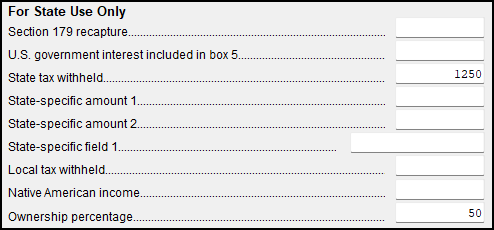

Open the federal K1 screen. For the Ohio entry, click the second tab at the top, the 1065 K1 12-20 tab.

On the right-hand side of the screen, enter Ohio withholding in State tax withheld. Enter the percentage of ownership in Ownership percentage. Enter the percentage, not a decimal. For example, 50% would be entered as 50. The information will flow directly from the federal data entry to the Ohio return. Do not duplicate these entries on the Ohio PASS screen.

If there are multiple K1s, and part of those are entered on the federal screens and the remainder entered on the state screens, the total amount withheld from all of the K1s will flow to the Pass-Through credit line. Exercise caution if using this data entry method. Duplicate entries will result in an inaccurate credit amount.

If there is no federal K1 entered and information needs to be entered for the state return only, enter it on the federal K1 screen and it will flow to the Ohio return. You can enter a zero in the F box to exclude the amounts from the federal return.