Drake Tax - 1099-R - Box 7 Code J

Article #: 16070

Last Updated: December 05, 2024

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in ROTH IRA Contributions. This information must be entered for the software to calculate the taxable amount. Follow these steps to enter the distribution:

-

On screen 99R, enter the 1099-R as it was received, including the code J in box 7.

-

At the bottom of the 99R screen, check the box Exclude here; distribution is reported on: Form 8606.

-

Next, go to the ROTH screen. Code this screen as belonging to either the taxpayer or spouse by selecting either T or S in the TS drop list.

-

Enter the distribution in Part III, on line 19 Total Nonqualified ROTH IRA distributions received in 20YY.

-

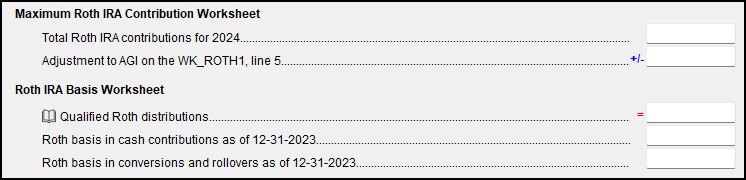

You will then need to determine the basis amounts and enter them as applicable in the lines at the bottom of the ROTH screen:

-

If anything is taxable it will calculate on Form 8606, line 25c and then flow to Form 1040, line 4b.

-

When there is a taxable amount on line 25c of the 8606, you must go to the 5329 screen and enter that amount on line 1 if they are subject to additional taxes on the early distribution amount. Review the 5329 Instructions for details on this additional tax.

-

Return Note 126 will generate in view mode when a 1099-R has a code of J on line 7 indicating that Form 5329 may be required.

-

Note If the Line 7 code consists of two letters, such as JP, enter one letter in each of the two drop-down boxes.

Review the 8606 Instructions for more information.